Everything that you need to know about the Upside Tasuki Gap candlestick pattern is here.

Today you’ll learn:

- What Is The Upside Tasuki Gap Candlestick Pattern

- How To Identify The Upside Tasuki Gap Candlestick Pattern

- Variants Of The Upside Tasuki Gap Candlestick Pattern

- How To Trade The Upside Tasuki Gap Candlestick Pattern

- Strategies To Trade Upside Tasuki Gap Candlestick Pattern

- Strategy 1: Pullbacks On Naked Charts

- Strategy 2: Trading The Upside Tasuki Gap With Resistance Levels

- Strategy 3: Trading The Upside Tasuki Gap With Moving Averages

- Strategy 4: Trading The Upside Tasuki Gap With RSI Divergences

- Strategy 5: Trading The Upside Tasuki Gap With Fibonacci

- Strategy 6: Trading The Upside Tasuki Gap With Pivot Points

- What Is The Success Rate Of The Upside Tasuki Gap?

- This is what you learned today

- Learn More

What Is The Upside Tasuki Gap Candlestick Pattern

The Upside Tasuki Gap is a Japanese candlestick pattern.

It’s a bullish continuation pattern.

Usually, it appears as a pause after a price move to the upside and shows rejection from lower prices.

The pattern is bullish because we expect to have a bull move after the Upside Tasuki Gap appears at the right location.

It’s a continuation pattern because before the Upside Tasuki Gap appears we want to see the price going up, thus it’s also a frequent signal of a trend continuation.

The Upside Tasuki Gap pattern is also a mirrored version of the Downside Tasuki Gap candlestick pattern.

How To Identify The Upside Tasuki Gap Candlestick Pattern

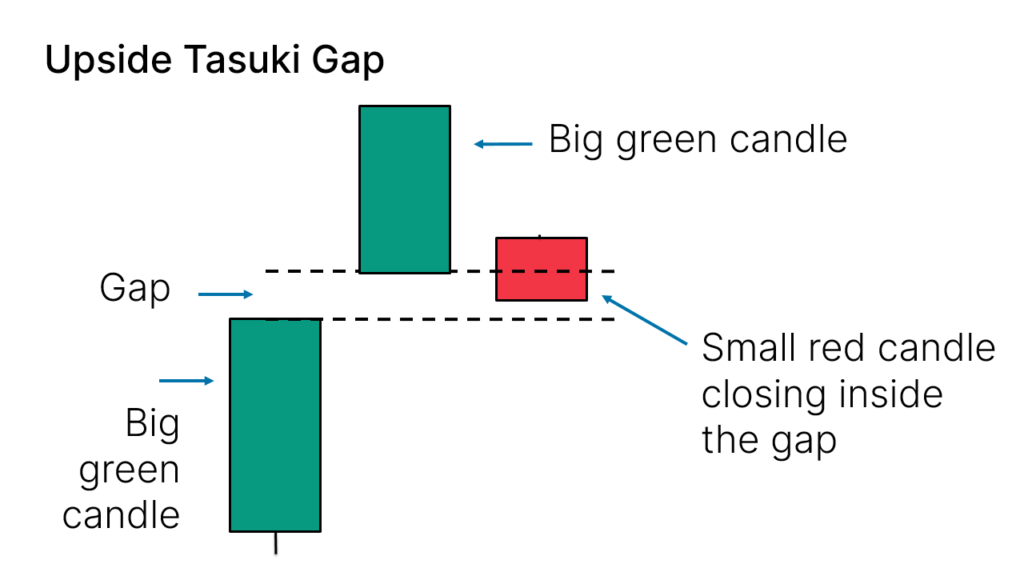

The Upside Tasuki Gap candlestick pattern is formed by three candles.

Here’s how to identify the Upside Tasuki Gap candlestick pattern:

- Two consecutive solid big green candles

- Between both candles, there’s a gap

- Finally, a small red candle will close inside the gap

It looks like this on your charts:

Variants of the Upside Tasuki Gap Candlestick Pattern

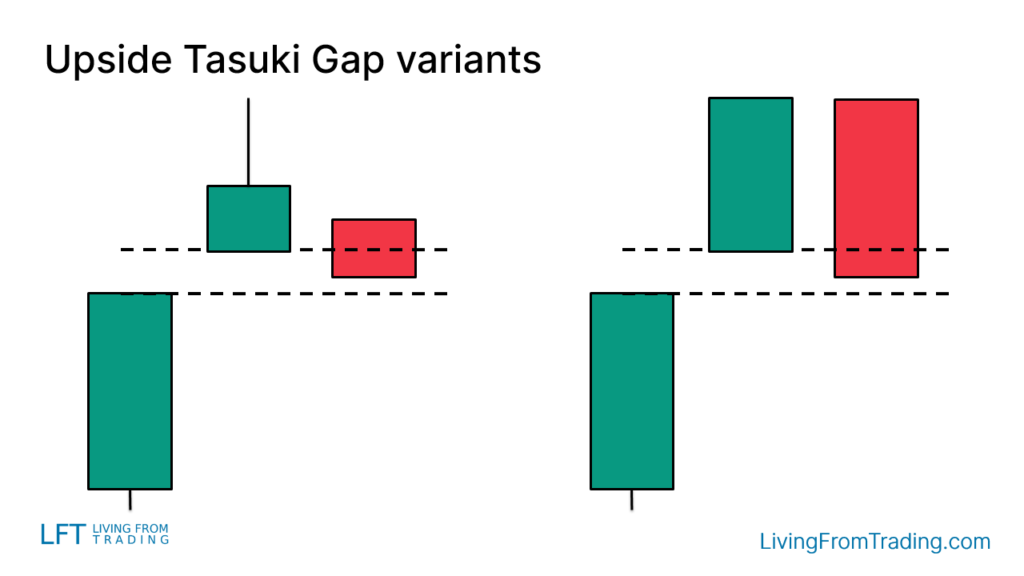

The Upside Tasuki Gap candlestick pattern may appear a little different on your charts.

The candles may or not have wicks.

The open of the last candle may have or not have a gap with the close of the second candle.

Here’s what it may look like on your charts:

How To Trade The Upside Tasuki Gap Candlestick Pattern

To trade the Upside Tasuki Gap candlestick pattern it’s not enough to simply find a series of candles with the same shape on your charts.

Let me explain.

What makes a pattern valid is not just the shape, but also the location where it appears.

This means that the same shape appearing at different locations may have different meanings.

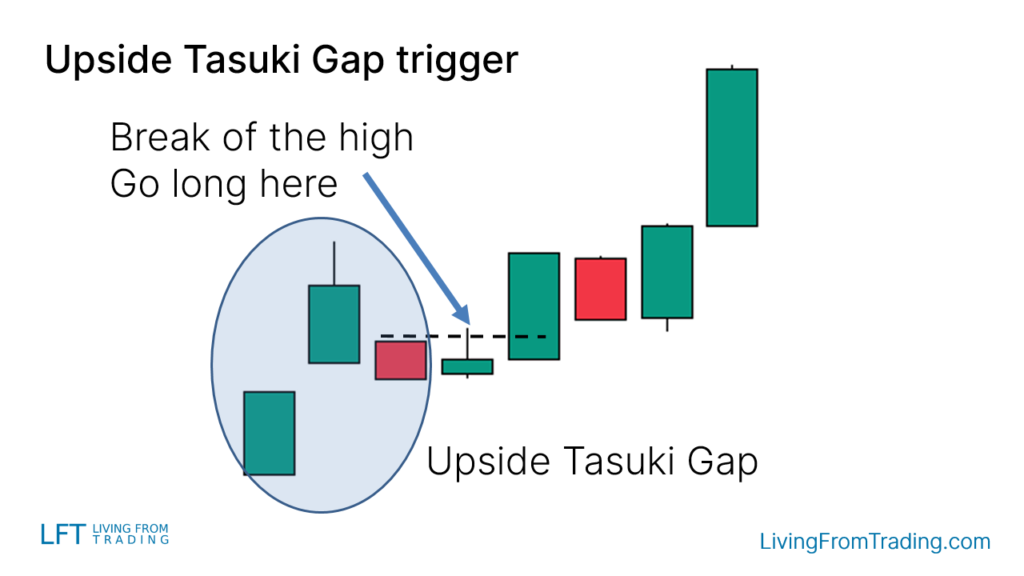

When trading the Upside Tasuki Gap, we want to see the price first going up, making a bullish move.

An Upside Tasuki Gap appearing after this bullish move is a sign of a possible trend continuation to the upside.

It looks like this:

Now you’re thinking.

“When do I open my trade?”

It’s simple, the Upside Tasuki Gap pattern is traded when the high of the last candle is broken.

That’s your conservative trigger to go long.

It looks like this:

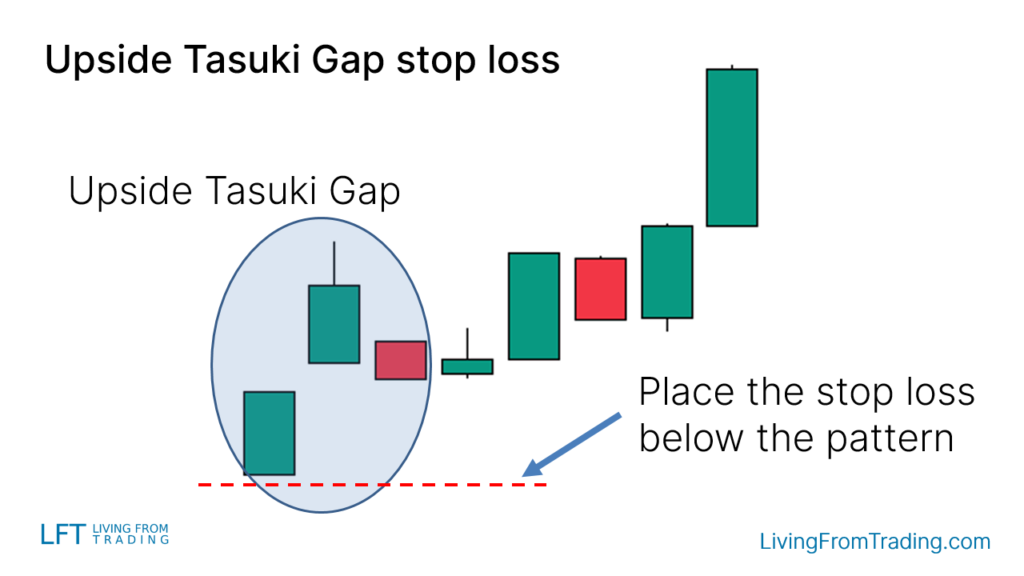

Now, you also want to protect yourself because when trading things don’t always move as we expect.

And for that, we use a stop loss.

There are several different types of stop losses.

The most common is to use the other side of the pattern to set it.

Like this:

But wait, don’t jump into trading the Upside Tasuki Gap right yet.

There are a few more things to know.

Ideally, to increase the accuracy, we want to trade the Upside Tasuki Gap candlestick pattern by combining it with other types of technical analysis or indicators.

Here are a few strategies to trade the Upside Tasuki Gap pattern.

Strategies To Trade The Upside Tasuki Gap Candlestick Pattern

Strategy 1: Pullbacks On Naked Charts

As a bullish continuation pattern, the Upside Tasuki Gap is a great pattern to watch for when the price is on an uptrend.

Just wait for a pullback to start, and then spot when the Upside Tasuki Gap appears.

That often signs the end of the pullback and the start of the new leg to the upside.

Here’s an example:

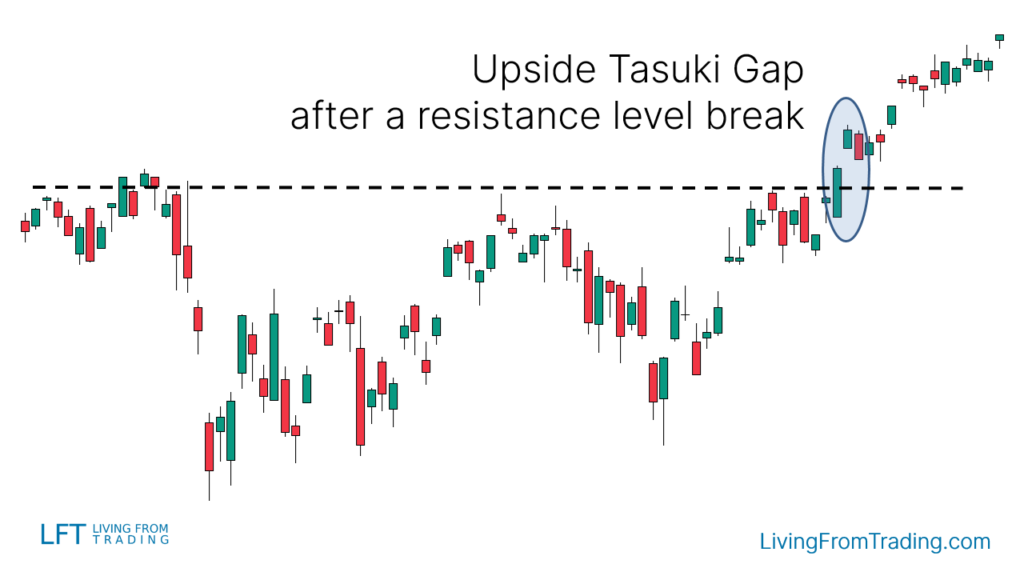

Strategy 2: Trading The Upside Tasuki Gap With Resistance Levels

Support and resistance levels are great places to find entries.

Since we are looking for continuation moves to the upside, we want to trade the Upside Tasuki Gap using resistance levels broken and then retested.

How does it work:

- Draw resistance levels on your charts

- Wait for the price to move to the upside hitting the resistance level and breaking it

- After that, you want to see the price coming back to retest the resistance

- Check if an Upside Tasuki Gap appears at that level

- Go long when the price breaks the high of the last candle of the Upside Tasuki Gap

- Set your stop loss and take profit levels, and expect a move to the upside

Here’s an example:

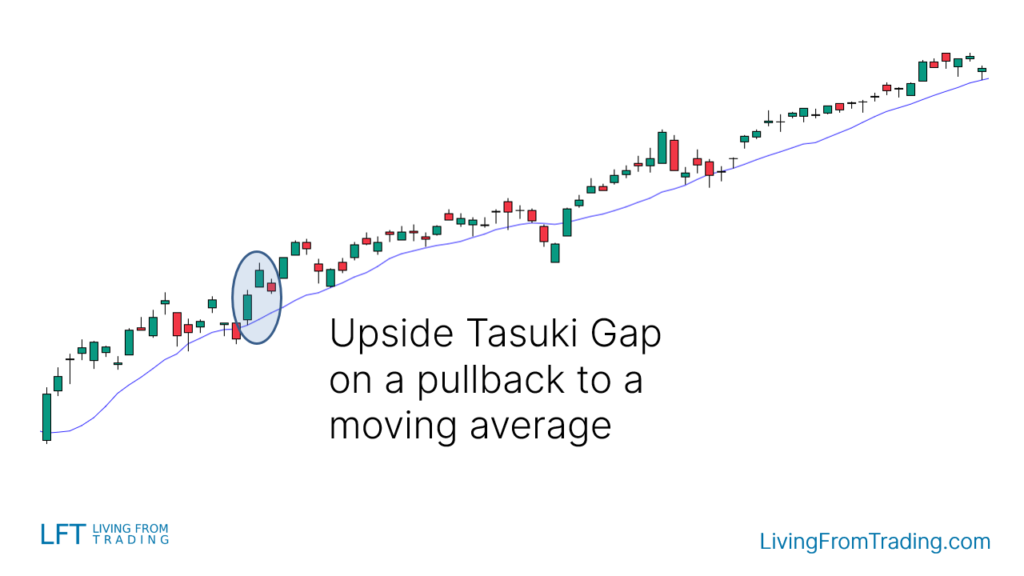

Strategy 3: Trading The Upside Tasuki Gap With Moving Averages

Moving averages are great trading indicators to trade trends.

The idea here is to trade pullbacks to the moving average when the price is on an uptrend.

How does it work:

- Find an uptrend, with the price jumping above a moving average

- Wait for a decline in the price to the moving average

- Check if an Upside Tasuki Gap appears at the moving average

- Go long when the price breaks the high of the last candle of the Upside Tasuki Gap

- Set your stop loss and take profit levels, and expect another leg to the upside

Like this:

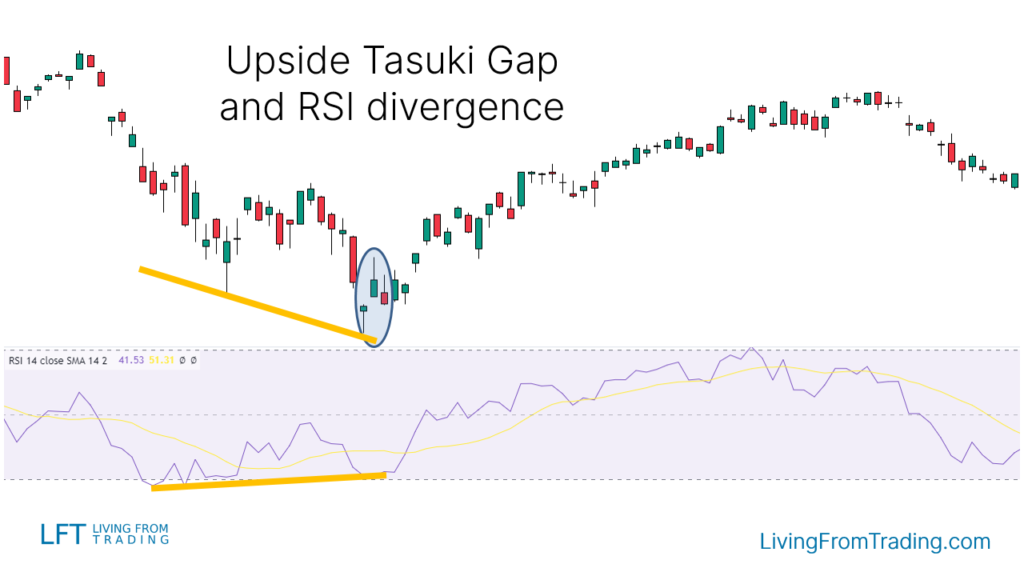

Strategy 4: Trading The Upside Tasuki Gap With RSI Divergences

This is a bit different from the other trading strategies.

To find a bullish RSI Divergence we want to see the price on a downtrend first, making lower lows and lower highs.

Here’s how it works:

- Find a downtrend

- Mark the lows that the price makes after each leg to the downside

- At the same time compare the price lows with the RSI indicator

- When you see the RSI making higher lows while the price making lower lows, you found your divergence

- Now you wait until an Upside Tasuki Gap appears at a price lower low, aligned with an RSI higher low.

- Go long when the price breaks the high of the last candle of the Upside Tasuki Gap

- Set your stop loss and take profit levels, and expect a move to the upside

Like this:

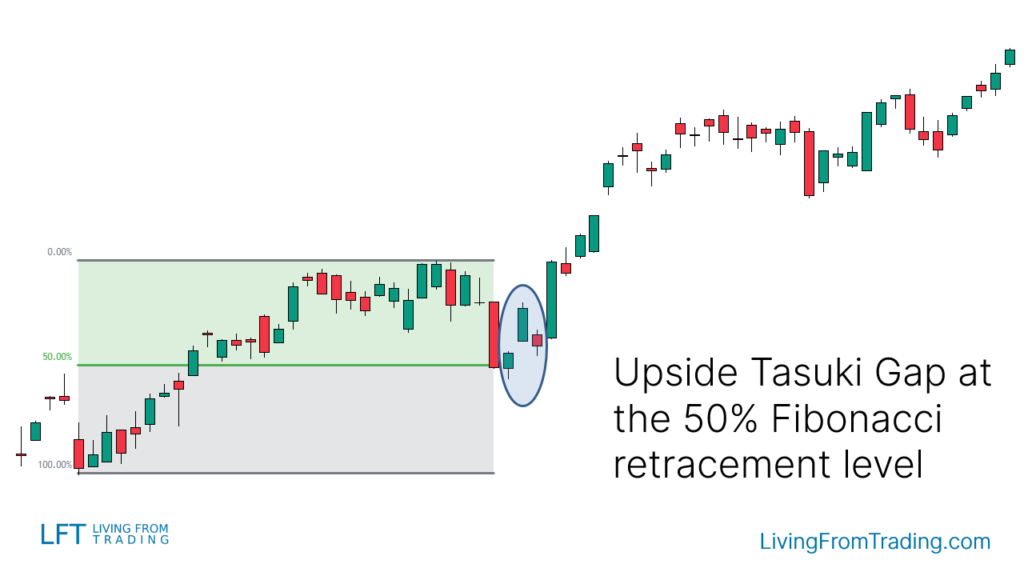

Strategy 5: Trading The Upside Tasuki Gap With Fibonacci

Another popular way of trading the Upside Tasuki Gap candlestick pattern is using the Fibonacci retracement tool.

Fibonacci shows retracement levels where the price will tend to revert frequently.

Depending on the strength of the trend, different levels are more likely to work better with the Upside Tasuki Gap pattern. Here you can learn more about the different Fibonacci retracement levels.

Here’s how the strategy works:

- You want to see the price on an uptrend

- Then you wait for a decline, they always happen at some point

- Pick your Fibonacci tool and draw the levels from the low to the high of the move

- When the price hits a Fibonacci level and prints an Upside Tasuki Gap, that’s what you are waiting for

- Go long when the price breaks the high of the last candle of the Upside Tasuki Gap

- Set your stop loss and take profit levels, and expect a move to the upside

Here’s an example:

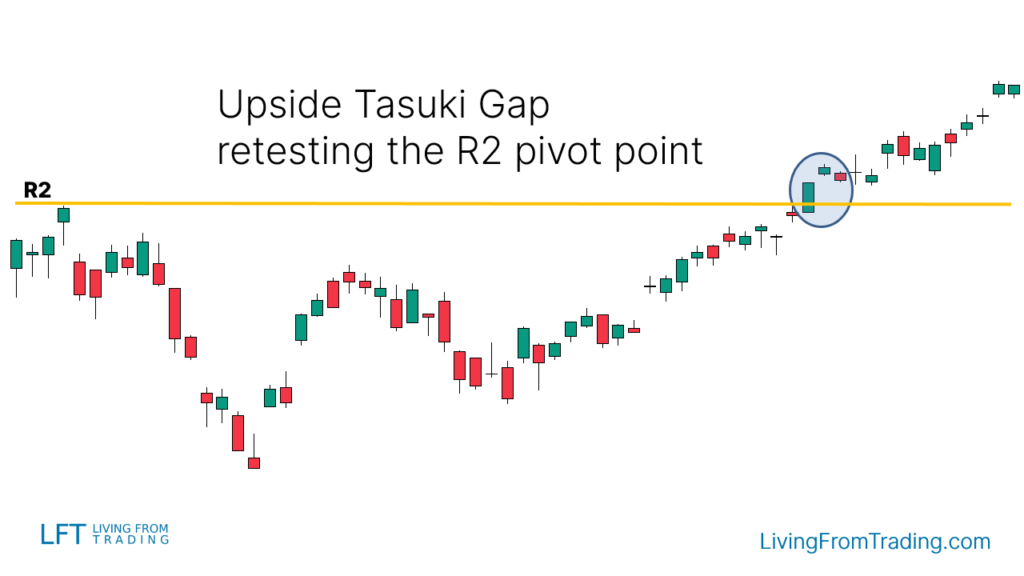

Strategy 6: Trading The Upside Tasuki Gap With Pivot Points

Pivot Points are automatic support and resistance levels calculated using math formulas.

If you are day trading, the Daily Pivot Points are the most popular, although the Weekly and Monthly are frequently used too.

Here’s how to trade the Upside Tasuki Gap pattern with Pivot Points:

- Activate the Pivot Points indicator on your charts

- Check which Pivot Points are above the price, those will tend to work as a support when broken

- Ideally, you want to see the price on an uptrend

- Wait for a move to the upside to a Pivot Point level and a break

- At that level, you want to see an Upside Tasuki Gap pattern appearing and retesting the level broken

- Go long when the price breaks the high of the last candle of the Upside Tasuki Gap

- Set your stop loss and take profit levels, and expect a move to the upside

It looks like this:

What Is The Success Rate Of The Upside Tasuki Gap?

According to the Encyclopedia of Candlestick Charts by Thomas N. Bulkowski (link), the Upside Tasuki Gap candlestick pattern has a success rate of 57%.

This is what you learned today

- The Upside Tasuki Gap is a three-candle pattern.

- To be valid, ideally, we want to see it during an uptrend.

- It’s a bullish continuation pattern, meaning that it signs a potential continuation of an uptrend.

- To increase the accuracy, you can trade the Upside Tasuki Gap using pullbacks, moving averages, and other trading indicators.

- The winning rate of the Upside Tasuki Gap is 57%.

Now I want to hear from you.

Do you trade the Upside Tasuki Gap candlestick pattern?

Let me know in the comments below.

Learn More

- List of all candlestick patterns explained