REVIEW SUMMARY

Trade The Pool is a Stocks prop firm, located in Israel. It was founded in 2016.

FEATURES

Instruments: .

Max balance: $4,000,000

Profit split: up to 80%

Cost: from $47

Platforms: Proprietary, Web, EdgeProX.

PROS & CONS

What I like:

- You trade with real money on a real trading account, not a sim account like other firms.

- The firm is specialized in Stocks, which is a rare thing.

- You can try any evaluation for free for 14 days.

- Day Trading and Swing Trading accounts available.

- You get 1-1 coaching, guidance and support.

What could be improved:

- Swing trading accounts could have a bigger buying power.

- The payout split for the smaller swing accounts is only 50%.

Trade The Pool is a prop trading firm located in Israel.

In this article, you’ll get a review of this prop firm, including analysis and instructions to get funded with an account from Trade The Pool.

Here’s what you’re going to learn:

- What Is Trade The Pool

- What Can You Trade With Trade The Pool?

- What Are The Trade The Pool Account Sizes?

- What Is The Trade The Pool Leverage?

- How Much Is The Trade The Pool Payout?

- Trade The Pool Reviews

- Trade The Pool Evaluation Program

- Trade The Pool EAs (Expert Advisors)

- Trade The Pool Free Trial

- Trade The Pool Free Repeat

- Trade The Pool Platforms

- Trade The Pool Trading Hours

- Trade The Pool News Trading

- Trade The Pool Payment Types

- Is Trade The Pool Legit?

- Trade The Pool Alternatives

- Recap

- Learn More

What Is Trade The Pool?

Trade The Pool is a prop firm located in Israel. It was founded in 2016, so it already has some experience with funding traders.

It was created to fund traders who love to trade the stock market. With basically no competition and an impressive selection of 12,000+ Stocks and ETFs, this can be a good company to fund your stocks trading account. You can even trade Penny Stocks if you are a fan of high volatility on emerging companies.

What Can You Trade With Trade The Pool?

Trade The Pool is a prop firm that funds traders to trade Stocks.

Here’s a list of all of the instruments:

- Stocks: More than 12,000 stocks are available, including Penny Stocks and ETFs.

All these stocks and ETFs are from the US Stock Market, the most popular market to trade, and that covers the necessities of the vast majority of stock traders.

It would be good though to have the possibility of trading in other markets. I’m pretty sure that traders from all over the world like Europe, India, Brazil, and several other countries and zones, would like to be able to trade their local stock market.

What Are The Trade The Pool Account Sizes?

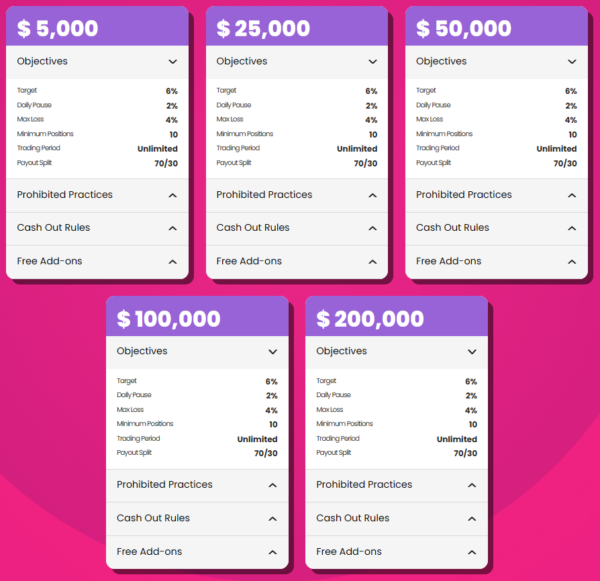

Trade The Pool funds traders with three different account balances. Besides that, you also have the option to choose between a Day Trading account or a Swing Trading account.

Let’s start with the Day Trading accounts.

Their balances, or let’s say more correctly, buying power, goes from $5,000 up to $200,000.

To gain access to a funded account you need to pass a 1-phase evaluation process. The price of the evaluation is different according to the account size that you are applying to.

The prices of the smaller funded account start at $47 and go up to $1475 for the bigger account. All these prices are one-time fees.

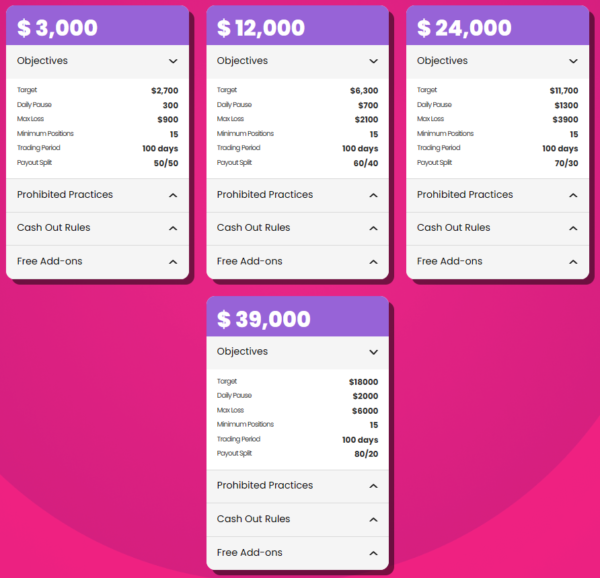

Now, let’s look at the Swing Trading accounts.

The buying power reduces significantly on these ones. The smaller one has $3,000 while the bigger one has $39,000.

The prices for these swing trading accounts range from $110 up to a $1340 one-time fee.

The balances can be scaled up to $4,000,000.

The process to gain access to a funded trading account is the same as the day trading accounts. You need to pass a one-step challenge. More on this later in this article.

What Is The Trade The Pool Leverage?

The prop firm account sizes are already the final buying power, so no leverage needs to be applied there.

How Much Is The Trade The Pool Payout?

The profit split is 50% for the smaller account and grows up to 80% for the bigger account. There are other prop firms with higher payouts, but we can say that this is pretty much the industry standard.

Trade The Pool Reviews

According to Trustpilot, Trade The Pool is classified as Excellent. It’s scoring 4.5/5.0 after 366 customer reviews.

Trade The Pool Evaluation Program

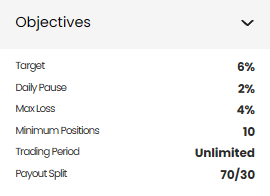

Day Trading Accounts – Flexible

The Flexible Day Trading Evaluation is the first option you have. There’s a profit target to achieve without any time limit. You also need to avoid exceeding a maximum drawdown and daily loss.

Here are all the details:

- Minimum days to trade: no minimum.

- Challenge duration: unlimited.

- Profit target: 6%.

- Maximum daily loss: 2%.

- Maximum drawdown: 4%.

- Minimum trades: 10 positions.

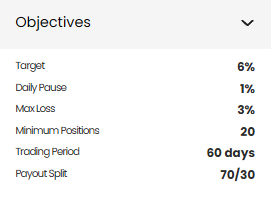

Day Trading Accounts – Disciplined

To pass the Disciplined Day Trading Evaluation you have a profit target to achieve within 60 days of trading. You also need to avoid exceeding a maximum drawdown and daily loss.

Here are all the details:

- Minimum days to trade: no minimum.

- Challenge duration: 60 days.

- Profit target: 6%.

- Maximum daily loss: 1%.

- Maximum drawdown: 3%.

- Minimum trades: 20 positions.

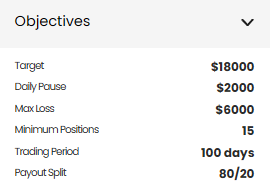

Swing Trading Accounts

If you are more into Swing Trading, the rules are a bit different here. Instead of 60 days, you now have 100 days to pass the evaluation process. That kind of makes sense since you probably take fewer trades when you are swing trading, than if you were day trading.

You also have a maximum daily loss and maximum drawdown to avoid in order to pass the challenge.

Here are the details for the swing trading evaluation phase:

- Minimum days to trade: no minimum.

- Challenge duration: 100 days.

- Profit target: 90% (smaller account) to 46.15% (bigger account)

- Maximum daily loss: 10% (smaller account) to 5.13% (bigger account)

- Maximum drawdown: 30% (smaller account) to 15.38% (bigger account)

- Minimum trades: 15

Trade The Pool EAs (Expert Advisors)

If you like to use EAs to trade, Trade The Pool is a great prop firm for you. They allow EAs, although some types of strategies are banned.

These include arbitrage trading or copy trading.

Trade The Pool Free Trial

Trade The Pool offers a 14-day free trial right now. Use the button below to access it.

Trade The Pool Free Repeat

Trade The Pool doesn’t provide free repeats. You can reset your account though, by paying a reset fee.

Trade The Pool Platforms

Trade The Pool gives you access to the Trader Evolution trading platform and a brand-new web platform that can also be used on your Mac.

Trade The Pool Trading Hours

If you’re trading the Swing Trading account, you can hold your trades overnight without any restriction.

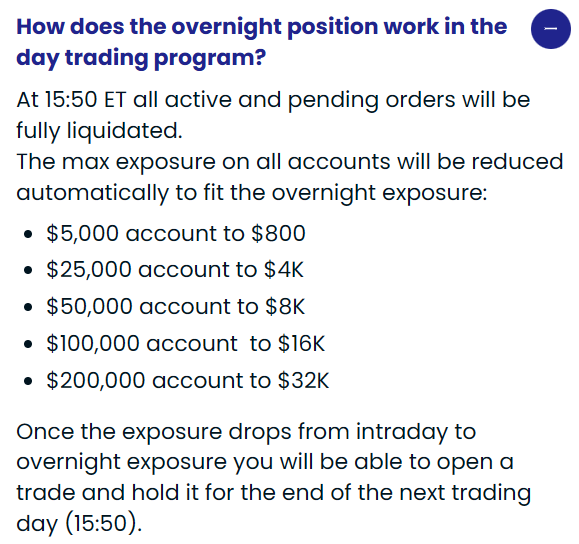

When it comes to the Day Trading account, there are some rules to comply with:

- By the end of the day (15:50 ET), you need to have all your orders closed, otherwise the system will close them for you.

- At that time, you can open new trades and hold them for the end of the next trading day.

- When you open a new trade overnight, your max exposure is more limited, you can only use 16% of your buying power.

Trade The Pool News Trading

There’s a simple restriction to news trading. You can’t hold a stock that is reporting earnings at after-market or premarket hours.

Besides this, there are no restrictions on news trading. You just need to be careful with the volatility, but if you’re like me, those are the best times of the day to trade. Just don’t exceed your maximum safe lot size and manage your trades properly.

Trade The Pool Payment Types

Here are all the payment types accepted by Trade The Pool:

- PayPal

- Crypto

- Credit Card

- Google Pay

Is Trade The Pool Legit?

Yes, Trade The Pool is a legit company.

Here are the contacts to reach them:

- Email: Help@TradeThePool.com

- Address: 14 Haroshet st, Raanaa, Israel

- Phone: 1.331.444.0024

You can also contact them through the live chat on their website.

Trade The Pool Alternatives

Here’s the list of the best Trade The Pool alternatives:

For more alternatives check our alternative prop firm tool:

Get Alternatives To Any Prop Firm

Recap

- Trade The Pool is a prop trading firm based in Israel.

- You can get a funded account with up to $200,000 in balance and up to 80% profit split payout.

- To get access to a funded account you need to pass a one-phase challenge program.

- You can trade Stocks, including Penny Stocks and ETFs

- The Trader Evolution platform is available to trade.

Learn More

- PropScan – challenge filter and selector

- List of the best prop trading firms

- List of the best stock prop firms

- Compare any prop firm