REVIEW SUMMARY

The Trading Pit is a Futures, and Forex prop firm, located in Liechtenstein. It was founded in 2021.

FEATURES

Instruments: Forex, Indices, Metals, Commodities, Stocks, Crypto, Equity Futures, Foreign Exchange Futures, Agricultural Futures, Energy, Interest Rates Futures, Metals Futures.

Max balance: $5,000,000

Profit split: up to 80%

Cost: from €99

Platforms: MT4, MT5, NinjaTrader, Rithmic, Volfix, ATAS, SierraChart, MotiveWave, Bookmap X-Ray, Jigsaw Daytradr.

PROS & CONS

What I like:

- The only firm where you can trade Forex/CFDs and real Futures.

- You can scale your account up to $5 Million.

- Quick funding, as low as 3 days if you can meet the objectives fast enough.

- Cheap challenges which are refunded with your first payout.

- Free trading platforms for Forex and Futures.

What could be improved:

- The default Forex leverage is only 1:50. Not big but still bigger than the ESMA requirements for brokers.

The Trading Pit is a prop trading firm located in Liechtenstein.

In this article, you’ll get a review of this prop firm, including analysis and instructions to get funded with an account from the Trading Pit.

Here’s what you’re going to learn:

- What Is The Trading Pit

- What Can You Trade With The Trading Pit?

- What Are The Trading Pit Account Sizes?

- What Is The Trading Pit Leverage?

- How Much Is The Trading Pit Payout?

- The Trading Pit Reviews

- Forex Challenge – Classic (1-Phase Evaluation)

- Forex Challenge – Prime (1-Phase Evaluation)

- Forex Challenge – Prime (2-Phase Evaluation)

- Futures Challenge – Classic (1-Phase Evaluation)

- Futures Challenge – Classic (2-Phase Evaluation)

- Futures Challenge – Prime (1-Phase Evaluation)

- The Trading Pit EAs (Expert Advisors)

- The Trading Pit Free Trial

- The Trading Pit Free Repeat

- The Trading Pit Platforms

- The Trading Pit News Trading

- The Trading Pit Payment Types

- Is The Trading Pit Legit?

- The Trading Pit Alternatives

- Recap

- Learn More

What Is The Trading Pit

The Trading Pit is a prop firm located in Liechtenstein.

What Can You Trade With The Trading Pit?

The Trading Pit is a prop firm that funds traders to trade Forex and (real) Futures.

Here’s a list of all of the CFD instruments:

- Forex

- Metals

- Energies

- Indices

- Shares

- ETFs

- Crypto

If you want to trade Futures, you have access to these instruments:

- Equity Futures

- Foreign Exchange Futures

- Agricultural Futures

- Energy Futures

- Interest Rate Futures

- Metals Futures

- Cryptocurrency Futures

- Bonds Futures

What Are The Trading Pit Account Sizes?

The Trading Pit has different challenges and account sizes depending if you’re trading Forex or Futures.

When trading the Challenge, the available Forex account balances are between €5,000 and €200,000. The price to take the challenge is €49 for the smaller account and up to €1139 for the bigger account.

In case you’re trading Futures, the account balances vary between $20,000 and $250,000. The price to take the Futures challenge is between €99 for the smaller account and €599 for the bigger one.

After getting funded, your account balances can grow up to €5,000,000 according to the scaling plan.

Important to note that your trading fee is refundable once you pass the evaluation phase.

What Is The Trading Pit Leverage?

The default Forex leverage is 1:50. For Indices and Commodities, the leverage provided is 1:10. If you’re trading Stocks or Cryptos, you can do it with a 1:2 leverage.

When it comes to the Futures account’s leverage, the trading account balance is the buying power, meaning that the leverage is 1:1.

How Much Is The Trading Pit Payout?

Forex accounts

The profit share depends on the account type.

For the Prime accounts, it’s 80%, either for the one-phase or two-phase evaluations.

For the Classic accounts, the profit share starts at a 50% or 60% profit split, depending on the account size. It can later be increased up to an 80% profit split according to the scaling plan. You get 80% of all the profits that you make once you get funded, and the prop firm keeps 20% for them.

Futures accounts

For futures trading, the profit share also depends on the account type.

For the Prime accounts, the profit share is fixed at 80%.

If you go to the Classic accounts, the profit split starts at 60% or 70% depending on your account size, and can increase up to 80%, as you move up on the scaling plan levels.

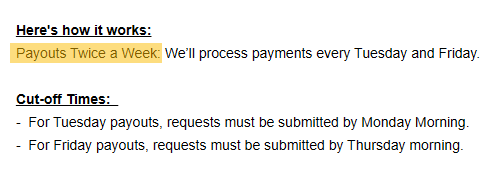

Payout frequency

Payouts are now processed twice a week. If you like the possibility of withdrawing often, this is a positive point for a good fit between you and this firm.

The Trading Pit Reviews

According to Trustpilot, The Trading Pit is classified as excellent. It’s scoring 4.8/5.0. It just doesn’t have tons of reviews, it’s about to hit 100 at the moment.

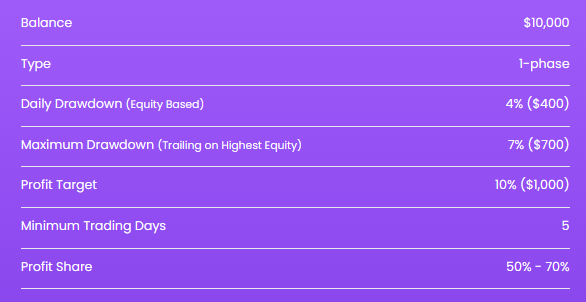

Forex Challenge – Classic (1-Phase Evaluation)

The Classic challenge lets you apply for an account with a starting balance from €10,000 and up to $100,000.

Here are all the rules:

- Minimum days to trade: 5 days.

- Challenge duration: Unlimited, trade for as long as you need.

- Maximum trailing drawdown: 7% (trailing on highest equity)

- Maximum daily drawdown: 4% (equity-based)

- Profit target: 10%

This challenge has one single phase. Once you pass it, you get funded with a 50% but up to 70% profit split

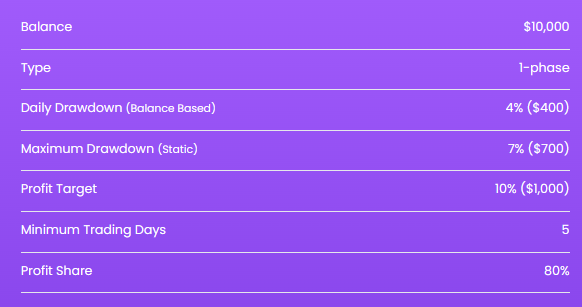

Forex Challenge – Prime (1-Phase Evaluation)

This Prime challenge lets you apply for an account with a starting balance from €5,000, up to $200,000.

Here are all the rules:

- Minimum days to trade: 5 days.

- Challenge duration: No limit.

- Maximum drawdown: 7% (static)

- Maximum daily drawdown: 4% (balance-based)

- Profit target: 10%

This challenge has one single phase. Once you pass it, you get funded with an 80% profit split

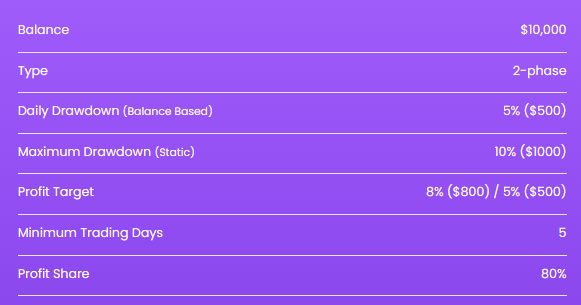

Forex Challenge – Prime (2-Phase Evaluation)

The Prime challenge also has this 2-phase variation if that’s what you prefer. Like the other Forex challenges, you can apply for an account with a starting balance of €5,000 and up to $100,000.

Here are all the rules:

- Minimum days to trade: 5 days.

- Challenge duration: Limits removed, you can take the time you need.

- Maximum drawdown: 10% (static)

- Maximum daily drawdown: 5% (balance-based)

- Profit target phase 1: 8%.

- Profit target phase 2: 5%.

This challenge has two phases. Once you pass them, you get funded with an 80% profit split.

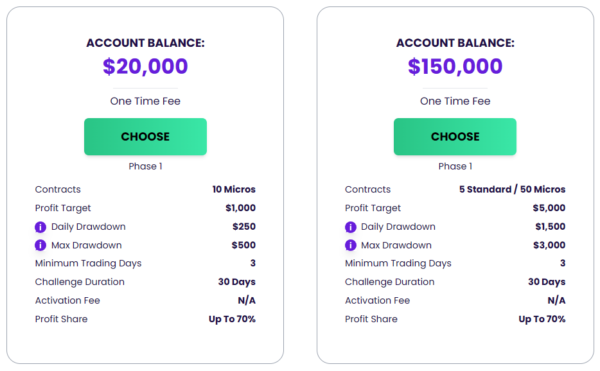

Futures Challenge – Classic (1-Phase Evaluation)

This 1-phase challenge lets you apply for an account where you can trade from 10 micro contracts up to 50 micros (or 5 standard). The balances available are $20,000 and $150,000. Quite a big gap in between.

Here are all the rules:

- Minimum days to trade: 3 days.

- Challenge duration: 30 days (with extension option).

- Maximum trailing drawdown: 2.5% for the smaller account and 2.0% for the bigger one.

- Maximum daily drawdown: 1.3% for the smaller account and 1.0% for the bigger account.

- Profit target: 5%

This challenge has 1 single phase. Once you pass it, you get funded with a 60%, and up to 70% profit split.

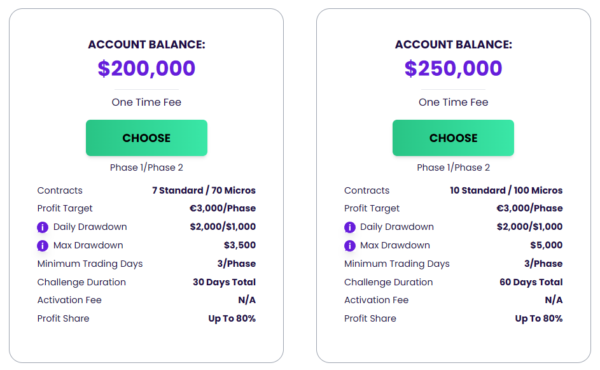

Futures Challenge – Classic (2-Phase Evaluation)

This is the 2-phase version of the classic challenge. This challenge lets you apply for an account where you can trade with up to 70 micro contracts (7 standard) and up to 100 micros contracts (10 standard).

Here are all the rules:

- Minimum days to trade: 3 days.

- Challenge duration: 30 days (with extension option).

- Maximum trailing drawdown: 1.8% for the smaller account and 2.0% for the bigger one and for both phases

- Maximum daily drawdown (phase 1): 1.0% for the smaller account and 0.8% for the bigger account.

- Maximum daily drawdown (phase 2): 0.5% for the smaller account and 0.4% for the bigger account.

- Profit target: 1.5% for the smaller account and 1.2% for the bigger account. It’s the same for both phases.

This challenge has 2 phases. Once you pass it, you get funded with a 60% (smaller account) to 70% (bigger account) and up to 80% profit split on both accounts.

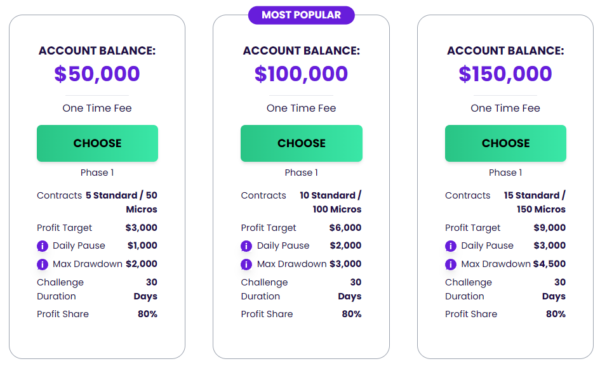

Futures Challenge – Prime (1-Phase Evaluation)

This challenge lets you apply for an account where you can trade with up to 150 micro contracts or 15 standard contracts. It has three account sizes available: $50,000, $100,000, and $150,000.

Here are all the rules:

- Minimum days to trade: 3 days

- Challenge duration: 30 days (total for both phases but with an extension option).

- Maximum trailing drawdown (EOD): 4.0% for the smaller account and 3.0% for the other ones.

- Maximum daily drawdown (daily pause, not a hard break): 2.0% regardless of the account size.

- Profit target: 6.0% regardless of the account.

This challenge has only one single phase. Once you pass them, you get funded with an 80% profit split.

The Trading Pit EAs (Expert Advisors)

You can use EAs/robots to trade but there are a few restrictions:

- You cannot copy trades that are not yours.

- You cannot scalp, the minimum trading duration is 1 minute.

- You cannot perform latency/reverse/hedge arbitrage trading.

- You cannot use emulators.

The Trading Pit Free Trial

Currently, the prop firm doesn’t offer free trials to traders.

The Trading Pit Free Repeat

There are no free repeats, but there’s a reset option in case you breach any rule.

The Trading Pit Platforms

Forex:

To trade a Forex account you have available the popular MetaTrader platform. You can select the MT4 or MT5 version.

Futures:

All Futures accounts come with free real-time data and a free Rithmic license key.

Besides that, The Trading Pit supports the most popular futures trading platforms.

You can use for free:

- NinjaTrader

- ATAS

- Rithmic/R/Trader

- Quantower

If you have a license, you can also use one of these platforms:

- Sierra Charts

- MotiveWave

- Jigsaw

- Volfix

The Trading Pit News Trading

If you like to trade news, then this is a good prop firm for you.

You just can’t open any trade within 2 minutes before and after a high-impact news event.

You can however close any trade during that period, or let a pending order be executed during that period, as long as it was set before the 2-minute window.

Make sure that you trade carefully during news time and have good risk management. Learn how to calculate your maximum lot size wisely.

The Trading Pit Payment Types

Here are all the payment types accepted by The Trading Pit:

- Wire

- Crypto

- Credit Card

- Google Pay

- Binance

- Perfect Money

Is The Trading Pit Legit?

Yes, The Trading Pit is a legit company.

Here are their contacts:

Address: Landstrasse 63, 9490 Vaduz, Liechtenstein

Email: support@thetradingpit.com

Phone: +4232379000

The Trading Pit Alternatives

Here is a list of the best The Trading Pit alternatives:

Futures alternatives:

Forex alternatives:

For more alternatives check our alternative prop firm tool:

Get Alternatives To Any Prop Firm

Recap

- The Trading Pit is a prop trading firm based in Liechtenstein.

- You can get a funded account with up to $5,000,000 in balance (after scaling) and up to an 80% profit split payout.

- To get access to a funded account you need to pass a challenge, with different rules and phases, depending on the account type that you want to apply to.

- You can trade Forex and real Futures.

- The popular MetaTrader platform is available to trade Forex.

- Amongst others, you can trade Futures using a free Rithmic platform, NinjaTrader, and others.

Learn More

- PropScan – challenge filter and selector

- What is prop trading

- List of the best prop trading firms

- Compare any prop firm

- The best Forex prop firms

- The best Futures prop firms