The psychology of a market cycle is a fascinating subject that delves into the mindset and behaviors of investors and traders during different stages of the market.

Understanding the psychological factors that drive market cycles can give investors an edge in making strategic decisions and potentially realizing greater returns.

Psychology Move Markets, Not News

The market is a constantly changing entity, and understanding the psychology of market cycles is crucial for investors and traders.

By identifying the psychological factors that influence market behavior, investors can better predict market movements and make more informed decisions.

In this article, we will delve into the psychology of market cycles and explore the different stages of the market and how they are affected by psychological factors.

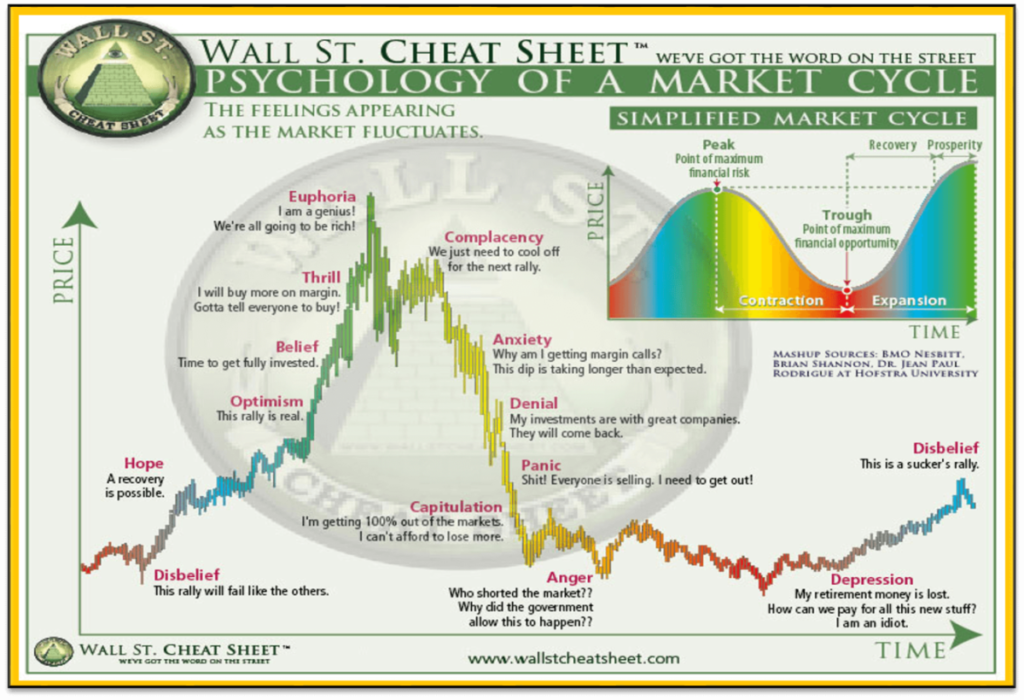

In case you’re wondering what a market cycle looks like, here’s the Wall St. Cheat Sheet – Psychology Of A Market Cycle:

1 – The Boom Stage – Optimism and Belief

The boom stage of the market is characterized by a period of rapid growth and increased investor optimism.

During this stage, investors are more likely to take on greater risk and engage in speculative behavior, as they believe that the market will continue to rise.

However, this optimism can be dangerous as it can lead to overvaluation and a subsequent market crash.

2 – The Bubble Stage – Thrill and Euphoria

The bubble stage of the market is characterized by a period of irrational exuberance and overvaluation.

During this stage, investors are driven by the fear of missing out and are willing to pay exorbitant prices for assets that are not supported by fundamentals.

This stage is often followed by a market crash, as investors realize that the prices of assets are not sustainable.

3 – The Crash Stage – Anxiety, Denial, and Panic

The crash stage of the market is characterized by a period of rapid decline and increased investor panic.

During this stage, investors are more likely to sell their assets at a loss, as they believe that the market will continue to fall.

This panic can exacerbate the decline, as more and more investors sell their assets, creating a self-fulfilling prophecy.

4 – The Bear Market Stage

The bear market stage is characterized by a prolonged period of decline and investor pessimism.

During this stage, investors are more likely to adopt a wait-and-see approach, as they believe that the market will continue to fall.

However, this stage can also present opportunities for savvy investors, as assets may be undervalued and present attractive buying opportunities.

5 – The Recovery Stage

The recovery stage of the market is characterized by a period of gradual growth and increased investor optimism.

During this stage, investors are more likely to take on risk and engage in speculative behavior, as they believe that the market will continue to rise.

However, it is important to note that the recovery stage can be fragile, and a market crash can occur if conditions change

6 – The Bull Market Stage

The bull market stage is characterized by a prolonged period of growth and investor optimism.

During this stage, investors are more likely to adopt a buy-and-hold strategy, as they believe that the market will continue to rise.

However, it is important to note that the bull market stage can be followed by a bear market, as conditions change and investor sentiment shifts.

7 – The Overvaluation Stage

The overvaluation stage of the market is characterized by a period of irrational exuberance and overvaluation.

During this stage, investors are driven by the fear of missing out and are willing to pay exorbitant prices for assets that are not supported by fundamentals.

This stage is often followed by a market crash, as investors realize that the prices of assets are not sustainable.

8 – The Correction Stage

The correction stage of the market is characterized by a period of decline and increased investor caution.

During this stage, investors are more likely to adopt a wait-and-see approach, as they believe that the market will continue to fall.

However, this stage can also present opportunities for savvy investors, as assets may be undervalued and present attractive buying opportunities.

The Role Of Emotions In Market Cycles

Emotions play a significant role in market cycles, as they can drive investor behavior and influence market movements.

Fear and greed are two emotions that can have a particularly powerful impact on the market.

Fear can lead to panic selling and a market crash, while greed can lead to irrational exuberance and a bubble.

Understanding the role of emotions in market cycles can help investors make more informed decisions and potentially avoid costly mistakes.

Strategies For Navigating Market Cycles

Surfing market cycles can be challenging, but there are strategies that investors can use to potentially increase their chances of success.

One strategy is to adopt a long-term perspective and focus on fundamentals rather than short-term market movements.

Another strategy is to diversify investments and avoid putting all eggs in one basket.

Additionally, having a clear and well-defined investment strategy can help investors stay disciplined and avoid impulsive decisions.

Conclusion

The psychology of market cycles is a complex and ever-changing subject, but by understanding the psychological factors that drive market behavior, investors can make more informed decisions and potentially realize greater returns.

Adopting a long-term perspective, diversifying investments, and having a clear investment strategy are all strategies that can help investors navigate market cycles and potentially increase their chances of success.