Today you’ll learn everything about prop trading and how can you become a prop trader.

Ready?

Here are the topics:

- What Is Prop Trading?

- What Strategies Are Used By Prop Traders?

- Prop Trading vs Hedge Fund

- Prop Trader Salary

- How To Start Prop Trading

- Is Prop Trading Worth It?

- What Is The Proprietary Trading Volcker Rule?

- This Is What You Learned Today

- Learn More

What Is Prop Trading?

Prop trading, a short form of Proprietary Trading, refers to trading firms and institutions that trade using their own money rather than their client’s money.

The prop trading activity can happen in all markets, from stocks to futures, forex, bonds, and even crypto.

Why would these firms trade their own money?

Because they believe that they have an edge over the retail traders or investors.

Prop trading firms tend to have better information, sometimes even inside information.

They also use advanced software, either commercial or owned by them, to create sophisticated market models, allowing them to potentially make better trading and investment decisions.

Proprietary trading is also used as a way to hedge the firm’s investments. When there’s uncertainty in the markets, these trading firms will use their own money to hedge and try to reduce their losses.

What Strategies Are Used By Prop Traders?

Typically in the past, prop traders mainly acted as arbitrage traders and also delivered liquidity to their clients.

Nowadays things are different. With a lot of new prop firms appearing, almost any type of trading is used by prop traders.

Day trading, scalping, swing trading, everything is valid.

The only restrictions are on the risks that you take. You need to have really good risk management to stay within the limits, otherwise, you may lose your funded account.

So don’t think about using Martingale strategies or trade without a stop loss. That’s asking for trouble and will not end up well for you.

Prop Trading vs Hedge Fund

Typically, Hedge Funds use their client’s money to invest and trade. They gain commissions based on their trading activity and performance. This is known as flow trading.

They raise capital to trade from investors that are interested in investing their money.

When it comes to prop trading firms, they see proprietary trading as a way to gain more. As long as their investments are good, they don’t need to share the revenue with clients. All the profits stay with them.

When you trade as a prop trader, you often gain a bonus based on your performance, meaning that the trading firm shares the profits with you.

Prop Trader Salary

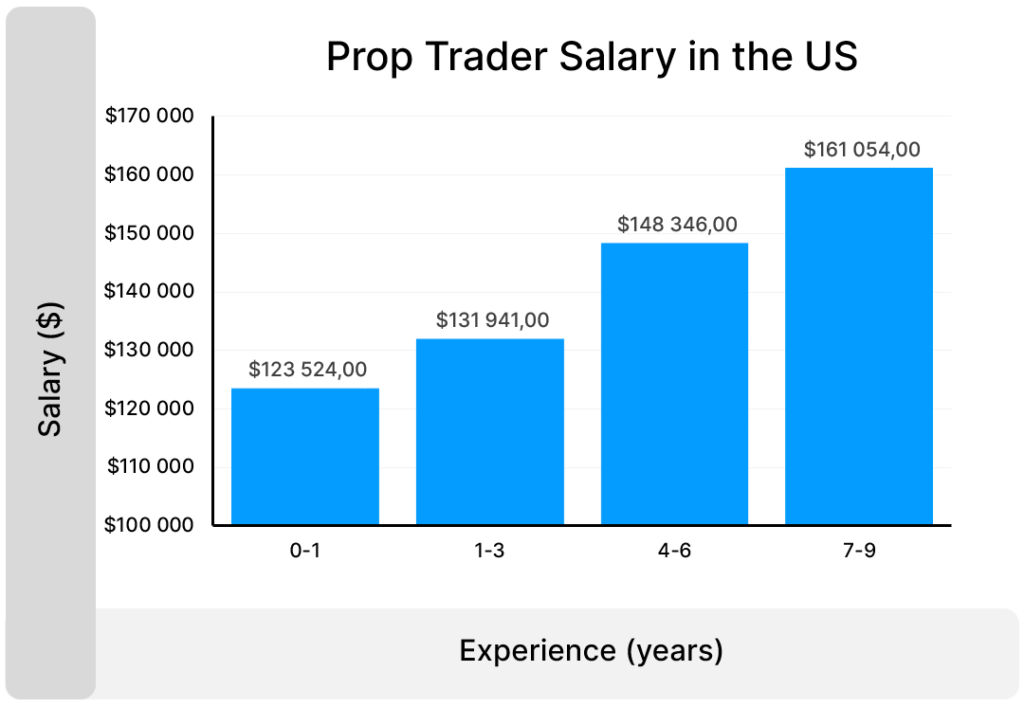

The average salary that prop traders make depends on their experience and increases over time.

On average, a Prop Trader in the US has a salary of $142,000 a year.

I found that traders with up to 1 year of experience make an average of $123,000 a year from their prop trading salary.

On the other end, traders with up to 9 years of experience, make an average of $161,000 a year from their prop trading salary.

It’s important to note that these prop trader salaries include the base salary and the bonuses as well.

Here’s a chart with the average prop trading salaries in the US, according to their trading experience.

Source: Glassdoor

These values presented are just averages. Good prop traders with decent experience and track records can make millions per year.

How To Start Prop Trading

Nowadays it’s easy to start prop trading.

A lot of firms are appearing, allowing retail traders to trade with their own money. Typically you just need to pay a small fee and pass their challenges before getting funded to trade.

To start prop trading you need to follow these steps:

- Learn how to trade

- Practice until you gain consistency

- Apply for a funded account in one of the best prop trading firms

- Pass their challenges, get funded, and start prop trading

- Keep trading with consistency and they will increase your capital over time

Is Prop Trading Worth It?

Everything that is related to trading tends to have a high degree of stress associated.

If you’re a person who can handle stress easily, then prop trading may be worth it.

The returns can be impressive too, they are way above the average salaries and theoretically have no limits.

You only need one thing more…

You need to love everything about trading and have the patience to commit to practicing over and over until you get good at it!

Trading is a job, and as with any other job, you need to love it if you want to get to the top and earn the best salaries while feeling happy with what you do.

Is Prop Trading Legal?

Yes, proprietary trading is legal, but not for everyone.

In the 2008 crisis, prop traders from big banks were responsible for billions of dollars in losses. Several banks collapsed, almost dragging the entire financial system with them.

In response to this situation, it was created the Volcker Rule, which prohibited big banks from prop trading.

So, as long as you’re not prop trading on behalf of a big bank, you’re not engaging in any illegal activity when prop trading.

What Is The Proprietary Trading Volcker Rule?

The Volcker Rule was created to protect the bank’s capital by reducing their risky activities.

Before the Volcker Rule, banks would engage in proprietary trading and would get all the profits for themselves. But when things went bad and they suffered significant losses, those losses were covered by money from their depositors.

Some banks even collapsed due to proprietary trading, like the Lehman Brothers, which affected not only the U.S. financial system but the whole world.

This Is What You Learned Today:

- Proprietary trading is done by firms that trade their own money instead of the client’s money

- As a prop trader, you can use any strategy, as long as you have a good risk management

- Hedge funds trade their client’s money, as opposed to proprietary trading

- The average salary of a prop trader is $142,000, but there are no limits.

- To start prop trading you only need to apply to a prop trading firm and pass their challenges

- If you want to be good prop trading, you must love the activity

- Prop trading is legal as long as it isn’t done by big banks

Now I want to hear from you.

Do you have experience as a prop trader or are you looking for this career?

Let me know below in the comments.