Everything that you need to know about the Hammer candlestick pattern is here.

Today you’ll learn:

- What Is The Hammer Candlestick Pattern

- How To Identify The Hammer Candlestick Pattern

- Variants of the Hammer Candlestick Pattern

- How To Trade The Hammer Candlestick Pattern

- Strategies To Trade The Hammer Candlestick Pattern

- What Is The Success Rate Of The Hammer?

- This is what you learned today

- Learn More

What Is The Hammer Candlestick Pattern

The Hammer is a Japanese candlestick pattern.

It’s a bullish reversal pattern.

It usually appears after a price decline and shows rejection from lower prices.

It’s a bullish pattern because we expect to have a bull move after a Hammer appears at the right location.

It’s a reversal pattern because before the Hammer appears we want to see the price going down, thus it’s also a frequent signal of the end of a trend.

The Hammer pattern is also a mirrored version of the Inverted Hammer Candlestick Pattern.

How To Identify The Hammer Candlestick Pattern

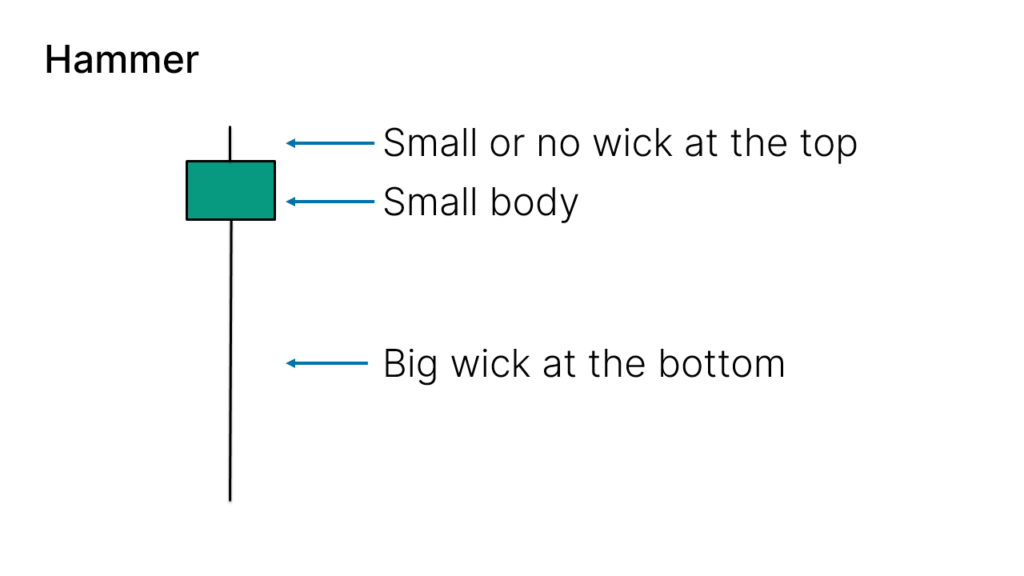

The Hammer candlestick pattern is formed by one single candle.

Here’s how to identify the Hammer candlestick pattern:

- The candle has a small body

- The wick at the bottom must be big compared to the body

- At the top, it should have no wick, or be very small

- The color of the body doesn’t matter

It looks like this on your charts:

Variants of the Hammer Candlestick Pattern

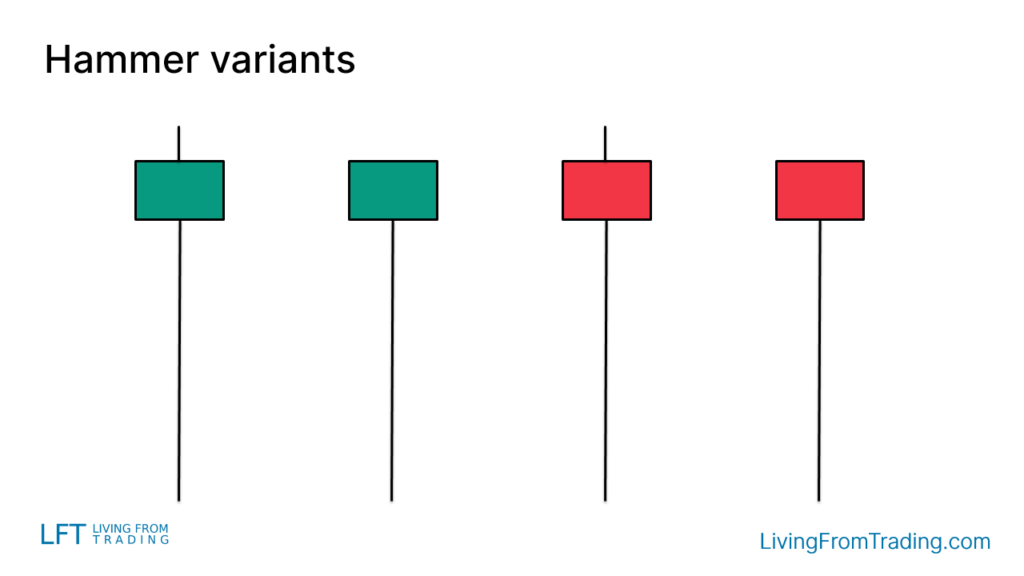

The Hammer candlestick pattern may appear a little different on your charts.

The color of the body doesn’t matter, it can be either red or green (bearish or bullish).

The existence or not of a wick (shadow) at the top doesn’t matter too. As long as it’s small you’re good to go.

Here’s what it may look like on your charts:

How To Trade The Hammer Candlestick Pattern

To trade the Hammer candlestick pattern it’s not enough to simply find a candle with the same shape on your charts.

In fact, there are other candlestick patterns that have the exact same shape, like the Hanging Man candle.

Confused?

Let me explain.

What makes a pattern valid is not just the shape, but also the location where it appears.

This means that the same shape appearing at different locations may have different meanings.

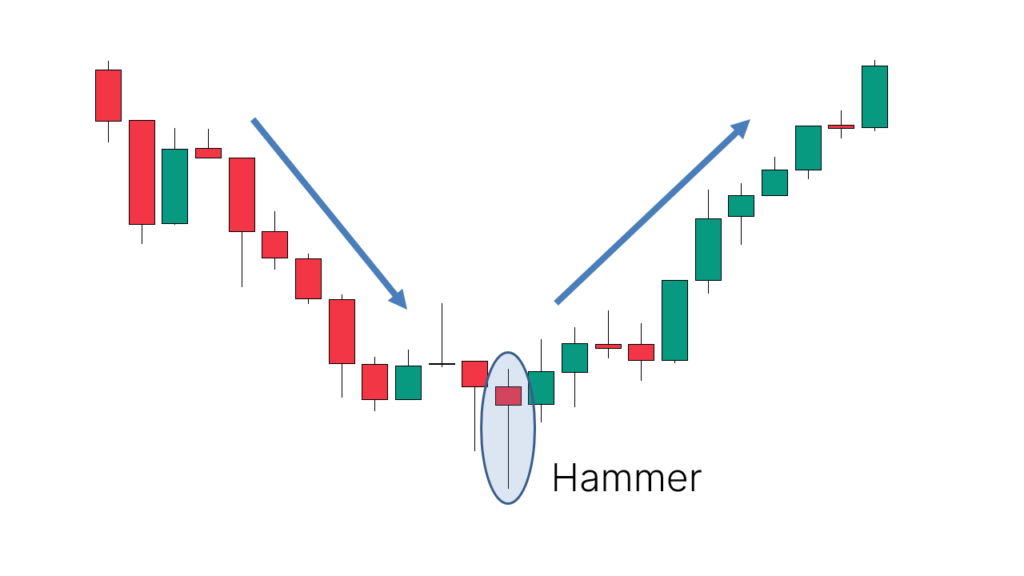

When trading the Hammer, we want to see the price first going down, making a bearish move.

A Hammer appearing after this bearish move is a sign of a possible reversal to the upside.

It looks like this:

Now you’re thinking.

“When do I open my trade?”

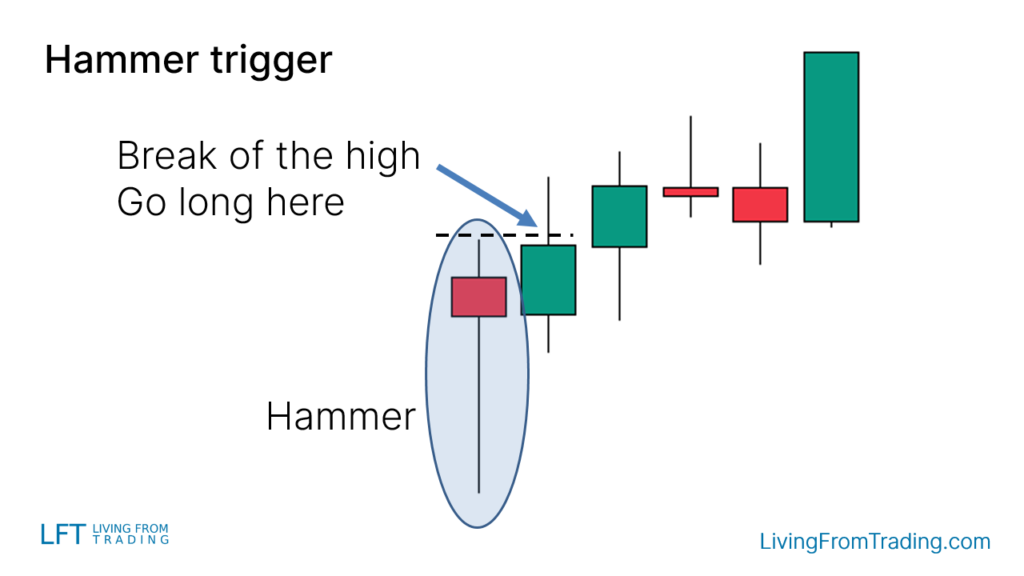

It’s simple, the Hammer pattern is traded when the high of the candle is broken.

That’s your conservative trigger to go long.

It looks like this:

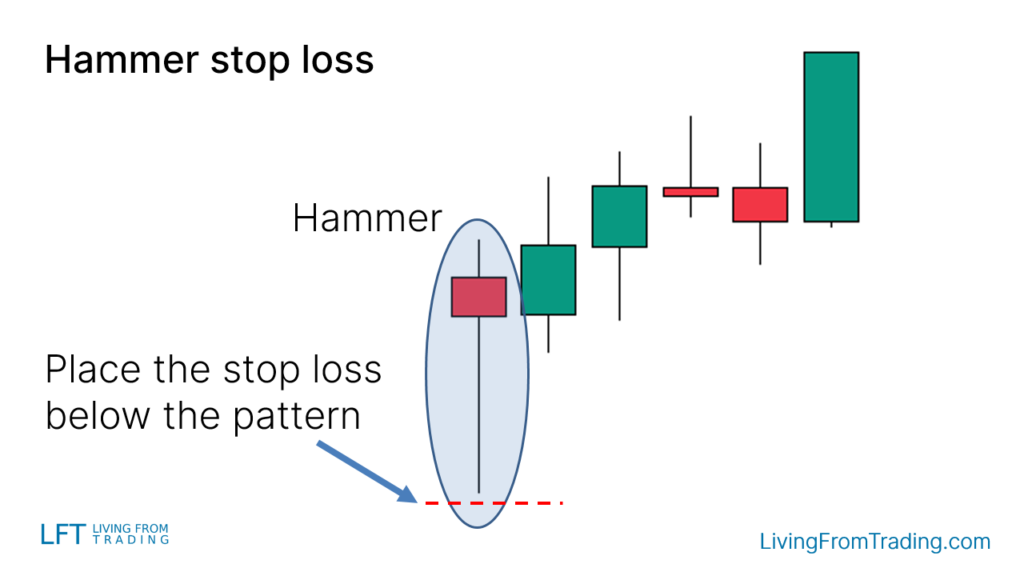

Now, you also want to protect yourself because when trading things don’t always move as we expect.

And for that, we use a stop loss.

There are several different types of stop losses.

The most common is to use the other side of the pattern to set it.

But wait, don’t jump into trading the Hammer right yet.

There are a few more things to know.

Ideally, to increase the accuracy, we want to trade the Hammer candlestick pattern by combining it with other types of technical analysis or indicators.

Here are a few strategies to trade the Hammer pattern.

Strategies To Trade The Hammer Candlestick Pattern

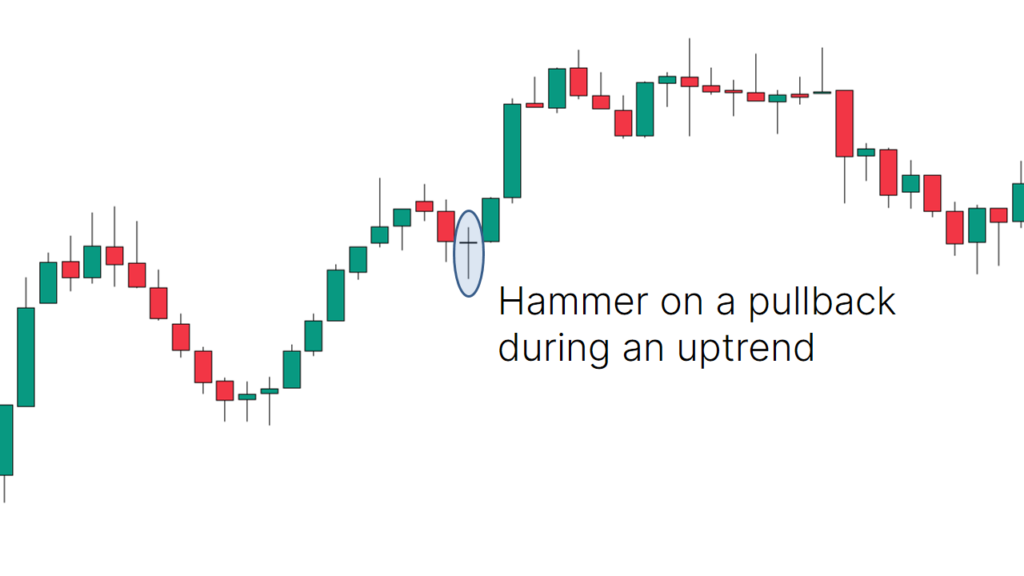

Strategy 1: Pullbacks On Naked Charts

As a bullish reversal pattern, the Hammer is a great pattern to watch for when the price is on an uptrend.

Just wait for a pullback to start, and then spot when the Hammer appears.

That often signs the end of the pullback and the start of the new leg to the upside.

Here’s an example:

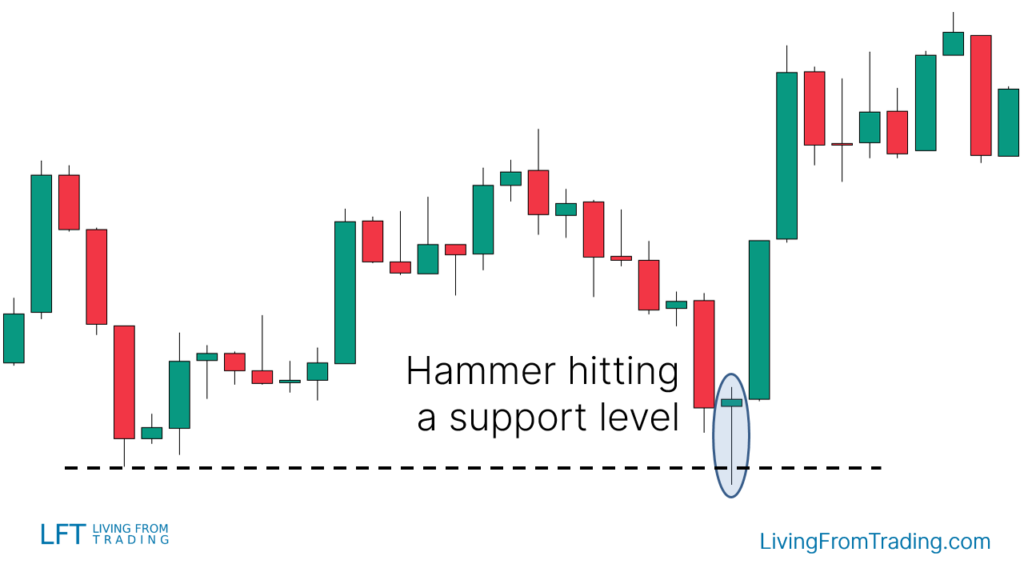

Strategy 2: Trading The Hammer With Support Levels

Support and resistance levels are great places to find price reversals.

Since we are looking for moves to the upside, we want to trade the Hammer using support levels.

How does it work:

- Draw support levels on your charts

- Wait for the price to decline and hit the support level

- Check if a Hammer appears at that level

- Go long when the price breaks the high of the Hammer

- Set your stop loss and take profit levels, and expect a move to the upside

Here’s an example:

Strategy 3: Trading The Hammer With Moving Averages

Moving averages are great trading indicators to trade trends.

The idea here is to trade pullbacks to the moving average when the price is on an uptrend.

How does it work:

- Find an uptrend, with the price jumping above a moving average

- Wait for a decline in the price to the moving average

- Check if a Hammer appears at the moving average

- Go long when the price breaks the high of the Hammer

- Set your stop loss and take profit levels, and expect another leg to the upside

Strategy 4: Trading The Hammer With RSI Divergences

This is a bit different from the other trading strategies.

To find a bullish RSI Divergence we want to see the price on a downtrend first, making lower lows and lower highs.

Here’s how it works:

- Find a downtrend

- Mark the lows that the price makes after each leg to the downside

- At the same time compare the price lows with the RSI indicator

- When you see the RSI making higher lows while the price making lower lows, you found your divergence

- Now you wait until a Hammer appears at a price lower low, aligned with an RSI higher low.

- Go long when the price breaks the high of the Hammer

- Set your stop loss and take profit levels, and expect a move to the upside

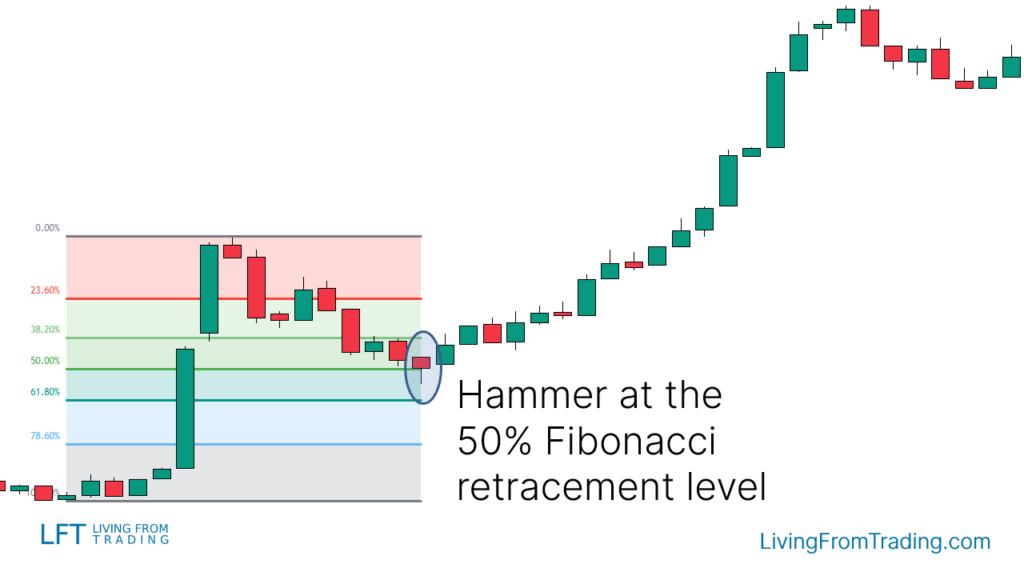

Strategy 5: Trading The Hammer With Fibonacci

Another popular way of trading the Hammer candlestick is using the Fibonacci retracement tool.

Fibonacci shows retracement levels where the price will tend to revert frequently.

Depending on the strength of the trend, different levels are more likely to work better with the Hammer pattern. Here you can learn more about the different Fibonacci retracement levels.

Here’s how the strategy works:

- You want to see the price on an uptrend

- Then you wait for a decline, they always happen at some point

- Pick your Fibonacci tool and draw the levels from the low to the high of the move

- When the price hits a Fibonacci level and prints a Hammer, that’s what you are waiting for

- Go long when the price breaks the high of the Hammer

- Set your stop loss and take profit levels, and expect a move to the upside

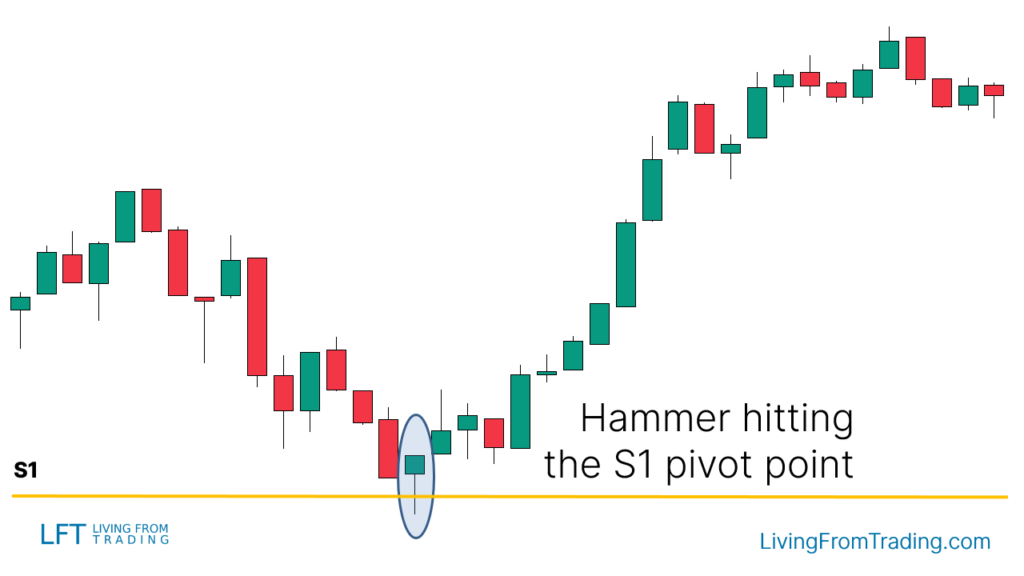

Strategy 6: Trading The Hammer With Pivot Points

Pivot Points are automatic support and resistance levels calculated using math formulas.

If you are day trading, the Daily Pivot Points are the most popular, although the Weekly and Monthly are frequently used too.

Here’s how to trade the Hammer pattern with Pivot Points:

- Activate the Pivot Points indicator on your charts

- Check which Pivot Points are under the price, those will tend to work as a support

- Ideally, you want to see the price on an uptrend, although is not required

- Wait for a decline of the price to a Pivot Point level

- At that level, you want to see a Hammer pattern appearing, meaning that the level is being rejected

- Go long when the price breaks the high of the Hammer

- Set your stop loss and take profit levels, and expect a move to the upside

What Is The Success Rate Of The Hammer?

According to the Encyclopedia of Candlestick Charts by Thomas N. Bulkowski (link), the Hammer candlestick pattern has a success rate of 60%.

This is what you learned today

- The Hammer is a single candle pattern.

- To be valid, it must appear after a move to the downside.

- It’s a bullish reversal pattern, meaning that it signs a potential reversal to the upside.

- To increase the accuracy, you can trade the Hammer using pullbacks, moving averages, and other trading indicators.

- The winning rate of the Hammer pattern is 60%.

Now I want to hear from you.

Do you trade the Hammer candlestick pattern?

Let me know in the comments below.

Learn More

- List of all candlestick patterns explained

I’m starting to teach myself about swing trading because I want to do it full-time when I retire from teaching. I’m glad that I stumbled upon this explanation of strategies for hammer candles. I’ve been reading about this candlestick, but you’ve provided specific ways that I can use them. The more I learn, the more I realize that I have to learn! Anyway, thanks!

Great to know you enjoyed it.

I read so many blogs on trading patterns but never got such details on their blogs. Thanks a lot for this in depth explanation

Thank you Zenith.