REVIEW SUMMARY

FTMO is a Forex prop firm, located in Prague, Czech Republic. It was founded in 2015.

FEATURES

Instruments: Forex, Indices, Metals, Commodities, Stocks, Crypto.

Max balance: $2,000,000

Profit split: up to 90%

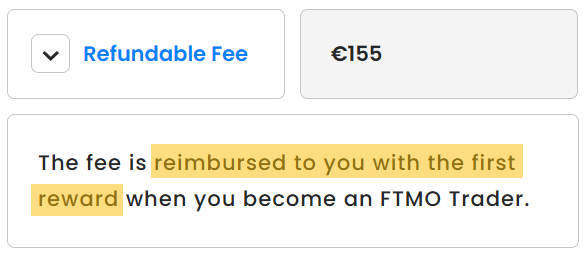

Cost: from €155

Platforms: MT4, MT5, cTrader, DXtrade.

PROS & CONS

What I like:

- Solid and respected firm, in operations for several years.

- You get back the challenge fee if you pass the evaluation steps and become an FTMO trader.

- Up to 90% profit split.

- You can pass any step of the evaluation in as low as 4 days.

- You have a free trial to test the system before you start a real challenge.

What could be improved:

- It has a 2-step evaluation so it's psychologically harder to get funded.

- You can only hold trades over the weekend or trade news if you're using the Swing account type.

FTMO is a prop trading firm based in the Czech Republic.

In this article, you’ll get a review of this prop firm, including instructions about the challenges and how to pass them to get funded with an FTMO funded account.

Here’s what you’re going to learn:

- What Is FTMO

- What can you trade with FTMO?

- What are the FTMO account sizes?

- What is the FTMO leverage?

- How much is the FTMO payout?

- What is the FTMO scaling plan?

- FTMO Reviews

- FTMO Challenge Rules (Step 1)

- FTMO Verification Rules (Step 2)

- FTMO Account (Step 3)

- Quantlane Trader (Step 4)

- FTMO EAs (Expert Advisors)

- FTMO Free Repeat

- FTMO Free Trial

- FTMO Platforms

- FTMO Trading Hours

- FTMO News Trading

- FTMO Payment Types

- Is FTMO Legit

- FTMO Alternatives

- Here’s What You Learned Today

- Learn More

What Is FTMO?

FTMO is a prop firm located in Prague, Czech Republic, and it has been funding traders since it was founded in 2015.

Back in 2014, FTMO founders used to participate in meetings with other day traders, and that’s where the idea flashed, but now they had to materialize the project.

Every trader has different approaches to trading. Could that be a problem?

Not really because what really matters is the discipline in following your own rules (as long as they work, of course!).

So, how do you keep traders disciplined?

Easy, a set of simple rules is enough. They help you maintain discipline, and avoid being too intrusive on your trading style.

And that’s how FTMO was born, creating a community of successful retail traders, and aiming to build an investment portfolio unprecedented in the world.

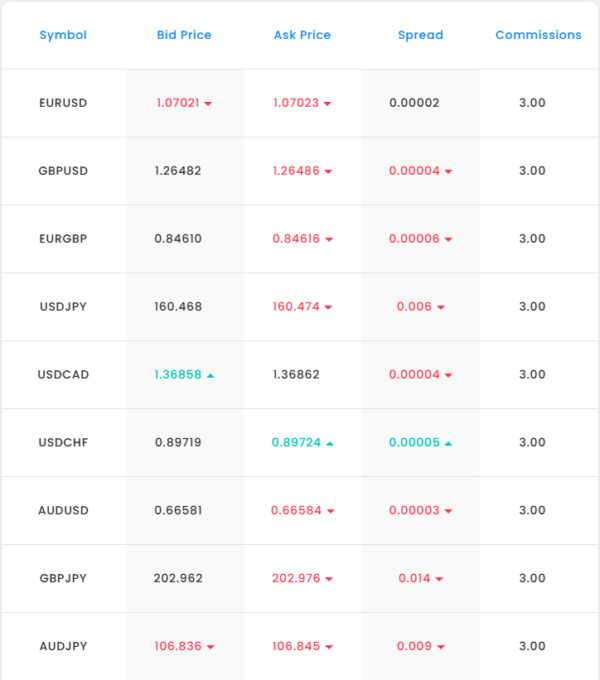

What can you trade with FTMO?

FTMO is a prop firm dedicated to Forex and other CFDs trading.

Here’s a list of the assets that you can trade with their accounts:

- Forex: All major, minor, and even exotic pairs are there if you are a Forex trader.

- Indices: Traded as Cash CFD, you have all the important indices available to trade including Dax, Nasdaq, Dow Jones, S&P500, FTSE, and others.

- Commodities: These include energies like Natural Gas, Crude, and Brent Oil, metals like Silver, Gold, or Palladium, and agricultural like Cocoa, Coffee, and Soybean, just to name a few.

- Stocks: The list is not big, only the 23 US stocks are available.

- Crypto: All the major cryptos are available, like BTC, ETH, LTC, XRP, ADA, DOT, DOGE, and a few more.

But to trade this, an account is needed.

And that’s what they give you.

A funded account to trade.

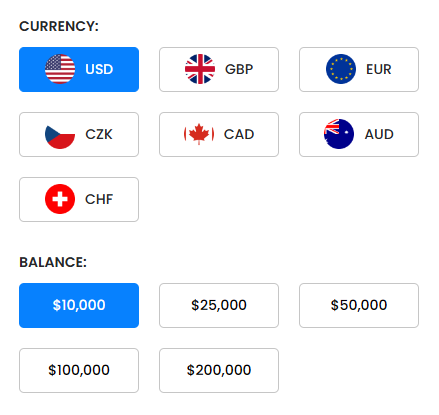

What are the FTMO account sizes?

This is where things get exciting because you have the potential to trade different account sizes, depending on your confidence.

There are five different available account sizes, and an interesting thing, is that they can have different currencies. You can trade in USD, GBP, EUR, and a few others.

If you’re a new trader, and you want to go to upgrade from the small account you have with your broker, you can start with the $10,000 funded account.

If, instead, you’re a seasoned trader and want to level up your trading potential, you can apply to an account as big as $200,000.

Only $200,000?

Hey, that’s a lot of money, but no, it doesn’t stop here.

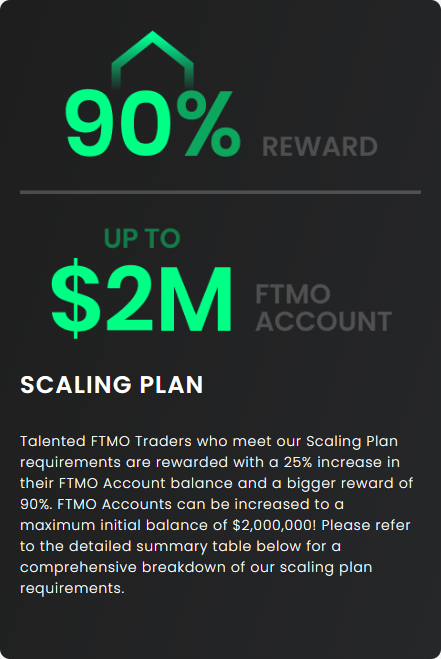

See, as you grow, your account will be scaled in 4-month periods, and this can lead to you having a funded account with up to $2,000,000.

Yep, that’s $2 million!

Now let’s talk about the costs.

The accounts are priced equally. The smaller the balance, the less you have to pay for the challenge.

The smallest account is priced at €155 giving you access to $10,000.

The prices increase up to the $200,000 account, where you need to pay €1,080.

That’s a one-time fee which will be refunded.

Once you pass the challenges and get the first payout you get that money back.

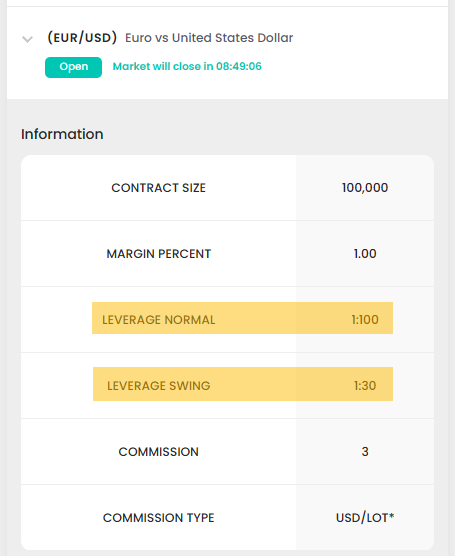

What is the FTMO leverage?

Here is where you get tricked by a lot of prop firms.

You know, some of them advertise really big account sizes, but then you can only open small lot sizes with them.

Why?

Because the leverage that these firms provide may be different from firm to firm.

The leverage determines the buying power that you have.

Although you should use leverage with caution, you may need a bare minimum to make decent profits. And the smaller the time frame you trade, the more you need it.

FTMO provides a decent and “normal” leverage on their accounts.

The Normal account has a bigger leverage since it’s designed for day traders. The Swing account has a reduced leverage.

This is what you get for each account and instrument category:

Normal accounts leverage:

- Forex pairs: 1:100

- Metals: 1:50

- Indices: 1:50

- Commodities: 1:50

- Crypto: 1:3.3

- Stocks: 1:10

Swing trading accounts leverage:

- Forex pairs: 1:30

- Metal: 1:15

- Indices: 1:15

- Commodities: 1:15

- Crypto: 1:1

- Stocks: 1:3

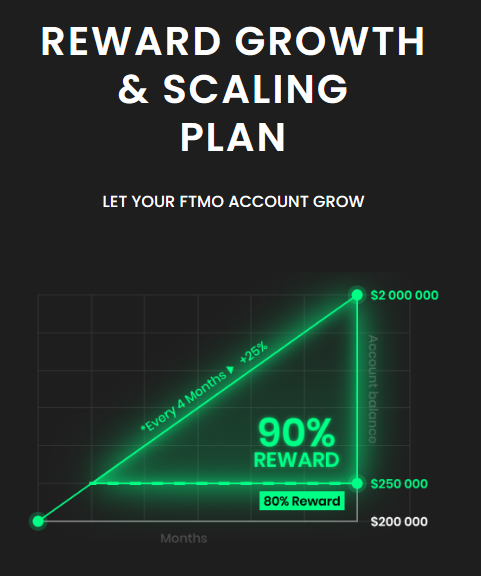

How much is the FTMO payout?

The FTMO payout profit split starts at 80:20. You get 80%, and the firm keeps the remaining 20%.

But it doesn’t stop here.

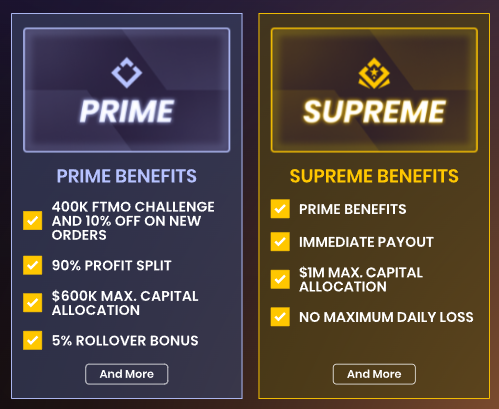

When you meet the conditions of their scaling plan, they increase the balance of your account, and at the same time, the payout also increases up to 90% for you.

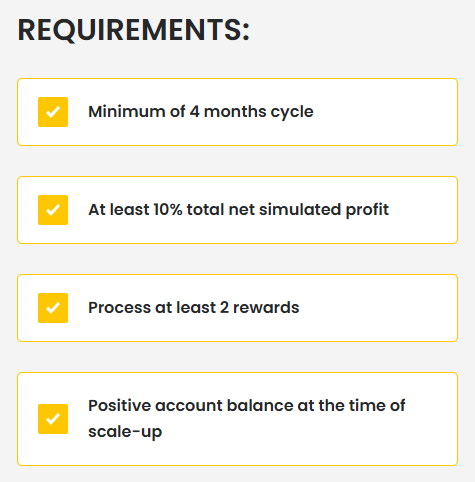

What is the FTMO scaling plan?

With their scaling plan, FTMO increases your account size in steps as you keep trading with consistency.

This rewards good traders and is an incentive for everyone to trade as a professional instead of gambling.

While you keep trading and getting good results with proper risk management, you’ll be able to potentially make more money as your account increases, without increasing the level of risk.

The capital increments happen in four-month cycles and you need to have made at least 10% of profit on your account. That’s an average of 2.5% per month.

The scaling plan will increase your account balance up to $2 million and the profit split will go up to 90%.

FTMO Reviews

According to Trustpilot, FTMO is very well classified in terms of reviews. The company has a staggering 4.9/5.0 after 4400+ reviews, which is quite impressive.

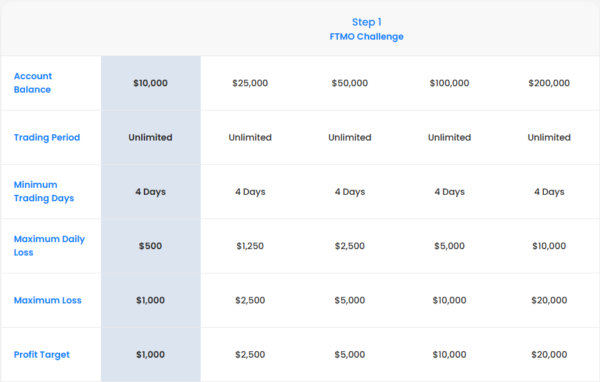

FTMO Challenge Rules (Step 1)

The Challenge is the 1st step of the evaluation process.

During the Challenge, you need to follow a series of rules to prove that you have good trading skills and discipline while trying to reach the objectives.

The FTMO Challenge doesn’t have any maximum duration. You can take as much time as you need without pressure to reach your objectives. In the past you had to complete the objectives within a certain period. Obviously, this caused many traders to have to rush their trades, and take trades that they shouldn’t. This limitation doesn’t exist anymore.

The challenge can be passed pretty quickly. You only need to trade for 4 days to be able to pass to the next step. Note that you need to open at least one position per day, so you need at least four positions opened in four different days to be able to pass.

Here are the basic rules of the FTMO Challenge (normal risk account):

- Trading period: No limit, take as much time as you need.

- Minimum trading days: 4 days.

- Maximum daily loss: 5% of the account.

- Maximum loss: 10% of the account.

- Profit target: 10% of the account.

And here’s a table with the values of the rules, considering a normal risk account:

FTMO Verification Rules (Step 2)

The Verification is the 2nd step in the FTMO evaluation and it’s much more relaxed than the previous step. If you were able to complete the 1st step easily, you should have no problem passing this one too.

The trading period and the minimum trading days remain the same. So, there’s no maximum trading period, and you need to place trades in four different days.

The rules to complete this step are pretty similar to the step 1 rules, except for the profit target that gets cut in half. Instead of 10%, you now only need to make 5% profit on your account.

Here are the rules for this step considering a normal risk account:

- Trading period: No limit, you can take your time to reach the goals.

- Minimum trading days: 4 days.

- Maximum daily loss: 5% of the account.

- Maximum loss: 10% of the account.

- Profit target: 5% of the account.

It’s important to notice that you don’t need to pay any fee to take step 2 of the FTMO challenge.

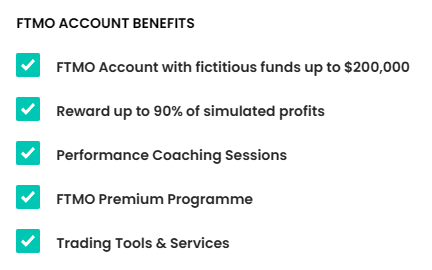

FTMO Account (Step 3)

Finally, this is the step where you can potentially start making real money, you now became an FTMO Trader.

If you reached Step 3, the funded account is now at your disposal to trade, and a lot of benefits come with the account, not just the opportunity to make money.

Now, you also get extra help to keep you succeeding. When you reach this level, FTMO will give you Performance Coaching Sessions, you’ll enroll in the FTMO Premium Programme, and you have at your disposal Trading Tools & Services.

This is also when you get your challenge fee back, once you get your first payout.

But do you think it ends here?

Heck, no!

There’s more to come if you keep proving yourself.

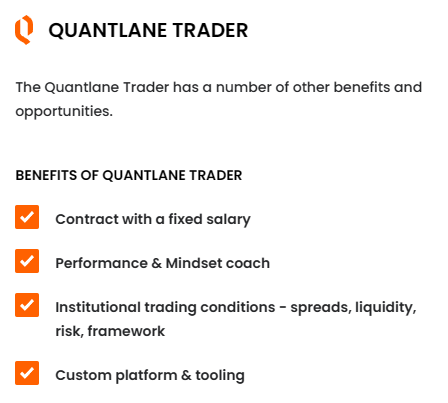

Quantlane Trader (Step 4)

The Quantlane Trader level is where you want to get if you really want to be a professional trader.

See, the previous level gives you an account to trade, but although the payouts are in real money, the account is simulated, which is a common practice in the prop firm industry.

To be able to reach this level you need to pass both steps of the challenge and also fulfill the conditions of the FTMO Premium Programme.

Once that’s complete you’ll get the opportunity to trade in a real market environment with institutional conditions.

To access this benefits you’ll be allowed to have an interview with Quantlane to apply for a position as a trader.

This comes with many benefits, like:

- Having a contract with a fixed salary.

- Performance and mindset coach.

- Institutional trading conditions, like spreads, liquidity, risk, and framework.

- Custom platform and tooling.

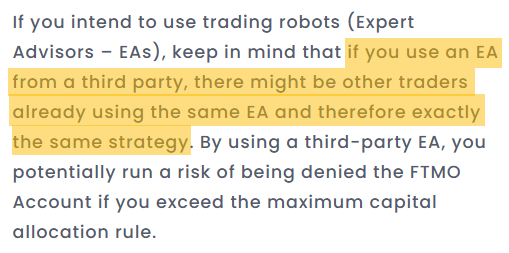

FTMO EAs (Expert Advisors)

If you like to use EAs to trade, FTMO is a great prop firm for you.

They allow EAs although the strategy should be able to be replicable on a live account.

There are a few things to take into consideration though.

1 – You can’t use EAs that are being used by other traders on FTMO. In practice, this means that it’s better if you use your own EA.

2 – Some EAs may place too many orders, or exceed the maximum capital allocation. You need to be careful with that. There’s a limit of 200 orders at a time and 2000 maximum positions open per day.

FTMO Free Repeat

FTMO offered free repeats of the Challenge in the past. Those were the days when you had 30 to 60 calendar days to complete the challenge.

Now that the pressure was removed, FTMO considers that free repeats are no longer needed.

If you’re having trouble passing the challenge with your losses, learn how to calculate the maximum safe lot size to avoid trouble breaking the drawdown rule.

FTMO Free Trial

The free trial is a simpler version of the Challenge. As the name states, it’s free but also doesn’t give you access to a funded account.

The free trial is good for traders who want to test the FTMO trading environment and see if they have what it takes to pass the Challenge. If you are able to pass the free trial successfully, you have a better chance to pass the Challenge too.

FTMO Platforms

FTMO gives you access to the most popular trading platforms used by Forex brokers. If you are a Forex trader, I’m pretty sure that you know how to use at least one of these trading platforms.

You can use:

- MetaTrader 4

- MetaTrader 5

- cTrader

- DXtrade

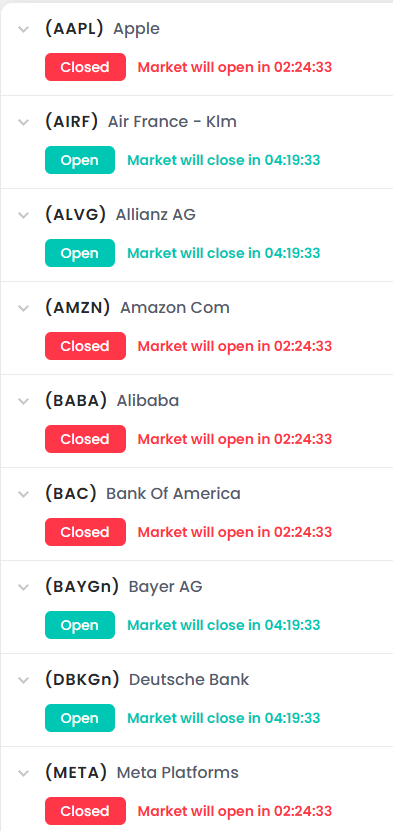

FTMO Trading Hours

When trading the challenges, FTMO has no requirement about position closing. You can keep them open overnight and during the weekend too.

The exception comes when you are funded with a FTMO account.

Unless you have a Swing Trading account, you are required to close your positions when the following happens:

- Just before the market closes for the weekend.

- When the overnight break period is longer than 2 hours.

This last rule applies to all stocks for example, so it’s good to know when does the stock market close so that you can be aware of the time limit to close your positions.

If you are trading crypto, since they usually run throughout the weekend, you may not need to close your existing open positions.

FTMO News Trading

When you are trading the FTMO Challenge, you can trade news without restrictions. There are no rules to close position during news releases.

When you are with a funded account, except for the swing account type, you have news trading rules to follow.

Two minutes before and after some important news releases, you are required to close positions from the assets that are affected by the news that is being released. Symbols that are not affected by the news can be traded normally.

FTMO Payment Types

Here are all the payment types accepted by FTMO:

- Wire

- Skrill

- Crypto

- Credit Card

- Nuvei

- Checkout.com

- Confirmo

Is FTMO Legit?

Yes, FTMO is a legitimate company.

Here are the contacts to reach them:

- Email: support@ftmo.com

- Phone: +44 2033222983

- Address: Quadrio offices, Purkynova 2121/3, 110 00 Prague, Czech Republic

FTMO Alternatives

Here’s the list of the best FTMO alternatives:

For more alternatives check our alternative prop firm tool:

Get Alternatives To Any Prop Firm

Here’s What You Learned Today

- FTMO is a prop trading firm based in the Czech Republic that allows you to trade Forex and other CFD instruments.

- You can get a funded account of up to $2 million with a profit split of up to 90%.

- To get access to an FTMO funded account you need to pass a 2-step challenge.

- When trading the simulated or live accounts you need to follow rules mainly related to good risk management.

- All common Forex trading platforms are supported by FTMO including MetaTrader, cTrader, and DXtrade.

Learn More

- PropScan – challenge filter and selector

- What is prop trading

- List of the best prop trading firms

- Compare any prop firm

- The best Forex prop firms