Day trading is one of the most popular trading styles amongst traders.

Today we’ll dive into all about day trading so that you can feel confident when taking the next step.

This is what we’ll cover:

- What is day trading?

- How do you start as a Day Trader?

- How much money do you need for Day Trading?

- What are the best markets for day trading?

- The best times to day trade

- Day trading strategies

- Conclusion

Let’s start.

What is Day Trading?

Day trading is the activity of buying and selling an asset within the same day. That’s the main difference between trading and investing.

It can be made in the Stock market, Futures market, Forex market, or even the Crypto market.

The time between the open and close of your trades can be very different, depending on the time frame used for day trading.

A special type of day trading, which is known as scalping, is done by opening and closing trades within a matter of a few minutes, if not a few seconds. Scalpers typically use very low time frames to trade, like the 1-minute.

Besides them, a typical day trader uses time frames that can range from the 5-minute to the 1-hour.

Those time frames lead to trades that can last from 5 minutes to several hours.

What all they have in common is that, at the end of the day, before the market closes, all their positions will be closed.

How do you start as a Day Trader?

Starting as a day trader is relatively easy.

Basically, you only need:

- Computer and monitor to trade

- Internet connection

- Trading account

- Trading platform

Well, at least in terms of hardware and software.

Because the most important piece of the puzzle is knowledge. You may have the best tools for any given activity, but you need to know how to use them to be successful. In trading, things are not different.

That’s why getting a trading course is highly recommended.

After that, consider taking part in a day trading community. Get together with other like-minded traders and go to war with them. It’s amazing how much faster a trader can evolve when he learns on a daily basis from the experience of other traders.

How much money do you need for Day Trading?

You don’t need much.

But that depends on the broker and market that you want to trade.

Forex/CFDs brokers costs

There are brokers that accept deposits as low as $5.

Those are typically CFDs brokers, the ones that are known to trade Forex, but they often offer other products to trade like Stocks, Indices, or even Crypto.

CFDs broker’s minimum deposits tend to range between $5-$200.

An example of these kinds of brokers is ICMarkets.

Curious how you can trade with so little money?

It’s simple, they offer a lot of trading leverage, which in simple terms, is how much they multiply your deposit by. So they basically lend you money to trade.

The leverage offered can range from 5x to 2000x.

Crazy, right?

Futures brokers costs

If you want to trade Futures, on a Futures broker, things are different.

Minimum deposits start at about $500.

But then you also have several other costs.

The platform cost typically can be bought or rented. The buying prices start at about $1 000 for the most popular ones.

Then you have to pay for the data.

This can go from several dozen to a couple of hundred dollars a month, depending on how many data providers you want to subscribe to.

An example of a popular Futures broker and platform is NinjaTrader.

Stock brokers costs

These may be really expensive.

The costs for platforms and data can be similar to the Futures broker’s costs. Although frequently, stock brokers also offer free platforms and free data.

The most important cost when it comes to trading stocks is the minimum deposit.

You know, there are two types of stock trading accounts: margin and cash. Knowing the difference between margin and cash accounts is important.

The thing is, both can be used for day trading, but they may have limitations.

To be able to day trade without restrictions, you need to have at least $25 000 in your trading account.

That’s known as the pattern day trader rule.

If your deposit is smaller, you can still day trade, but you are limited to taking 3 day trades within a 5 trading days period.

Not appealing, right?

What about getting funded to trade?

Let’s face it, although you can trade with a $500 account, that will not be enough to make a living from trading.

The solution that a lot of traders end up using is applying to a prop firm to get a funded trading account.

And there are several of them, like:

- FTMO funds accounts to trade Forex, Indices, and Crypto

- TakeProfitTrader funds accounts for Futures traders

- TradeThePool funds accounts for Stock Traders

What are the best markets for day trading?

Day traders need two major important factors present: volatility and liquidity.

These factors are different whether you are trading stocks vs indices vs forex.

Liquidity is related to the number and size of pending orders in the market. The bigger they are, the easier it is to absorb big-sized market orders and avoid sudden price jumps and gaps.

The Forex market is by far the most liquid market to trade. Then is followed by the Stock and Futures market. As long as you trade popular stocks or the best futures contracts, the liquidity should be good to trade.

Penny stocks, on the other hand, tend to have a lack of liquidity. The only exceptions are the ones that had some important recent news, which a lot of times means that they are being pumped and dumped.

Volatility is related to the speed of the market, to how fast the price moves.

The most volatile market is the crypto market, with astonishing disruptive moves. On the other hand, this volatility is only present during part of the long-term cycles, which may make them really slow to trade during certain periods.

The next most volatile markets are the Stock market and the Indices/Futures market.

On the other side of the spectrum, we have the Forex market. Things are just so slow there. Most of the time we need to wait so long for a small movement that our patience gets tested over and over. The only exception goes for when there are important economic news releases.

And the worst thing, the lack of volatility will make its moves be messy and less accurate. When trading Stocks and Indices, the trading setups are much easier and cleaner to identify.

So, what are the best markets for day trading?

- Stock market

- Indices/Futures market

- Forex market

- Crypto market

The best times to day trade

We already know what are the major factors that can impact Day Trading positively: volatility and liquidity.

So, let’s trade when there’s more volatility and liquidity.

There are certain times of the day that tend to be rich in volatility and liquidity.

And the best part?

Those times can often be used to day trade while working full time.

Now you don’t have the excuse to say you can’t day trade because you have another job.

Those times are:

The open and close of the markets

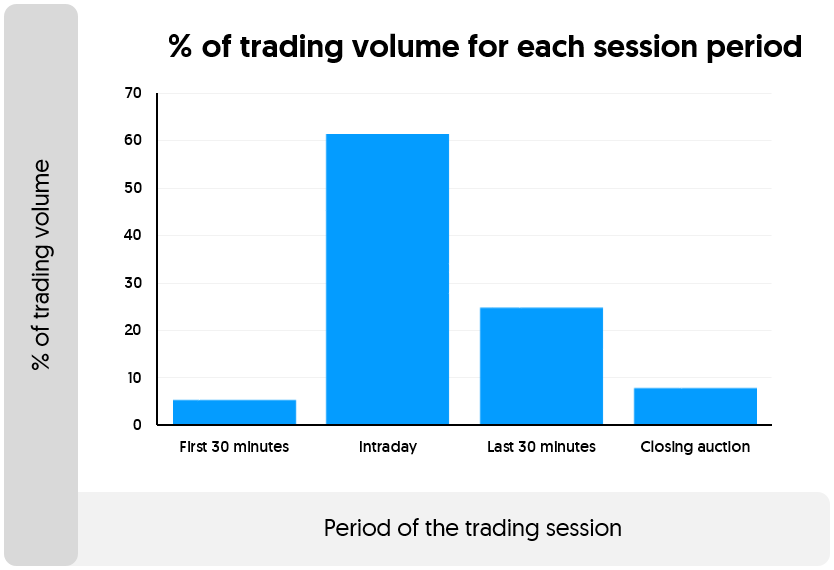

According to a study from the Jefferies Financial Group, 5.5% of the Average Daily Volume is traded during the first 30 minutes after the US market opening. The last 30 minutes are responsible for 25% of the volume. If we consider the closing auction, that number increases by 8.2% more. Although it’s not explicit, we can consider that the rest of the volume is done through the rest of the day.

By looking at the chart above, we may think that by skipping the 30-minute window of the open and close, the trading volume is bigger. But that’s not right, because that larger bar represents several consecutive trading hours. While the smaller ones are only 30 minutes each.

Because of this, learning how to trade the open of the markets is a must for any day trader that wants to be successful.

The open and close of the markets are special times of the day when day traders should focus to get more accurate trading setups and moves. The big trading volume in a short period of time translates into high liquidity and volatility.

Economic news releases

Important news releases tend to make the markets move a lot.

These news can be related to single companies, which will make their stocks move more than usual, attracting more market participants.

But can also be related to the global economy, like Forex news releases, that may affect the market as a whole in a lot of cases.

News about specific commodities may also make those related markets have good periods for day trading. Be aware of news releases about natural gas, and oil, and watch how fast they can move in a short period of time.

Day trading strategies

As a day trader, you need some kind of strategy to follow.

Most newbie traders just dive into trading without any knowledge or strategy and the results are not good.

Here’s a list of the most popular day trading strategies:

Trend trading strategies

These kinds of strategies aim to follow trends.

When the price is moving strongly in one single direction on a particular day, this is a good option to choose from to trade.

Trend-following strategies favor long trades when the day is on an uptrend, and give you short opportunities when the day is on a down trend.

Ignition candles are a great way to find the start of a trend.

Some popular trend trading strategies for day trading are the moving average trading strategies, the ascending triangles, or the use of Fibonacci to trade.

Range trading strategies

Price often moves between support and resistance levels, in a sideways manner.

When it hits a support level, it shifts direction and starts going up.

When it hits a resistance level, it shifts again and starts going down.

Range day trading strategies try to capture all these moves that the price makes between supports and resistances.

Breakout trading strategies

Breakouts are very popular but also riskier for the beginner trader.

A day trader that trades breakouts is a trader that believes that a particular resistance or support level will fail, so he will bet on the continuation of the move.

It’s useful to know a breakout trading strategy to include in your trading plan.

Reversal trading

Reversal day trading strategies aim to identify points where the trends are about to reverse.

When we are on an uptrend, we want to identify the start of a downtrend and start trading from there.

If we are on a downtrend, we want to find the inverse, the level where the trend is changing to an uptrend.

There are several ways to detect the end of a trend.

One of the most popular ways amongst traders is the identification of the Head and Shoulders pattern.

This is what you learned today:

- Day trading is the activity of buying and selling an asset within the same trading day.

- To start as a day trader you only need a trading account with a broker and a trading platform that will run on your computer connected to the internet.

- You don’t need much money to start day trading. The only exception goes for day trading stocks with a US broker.

- The best markets for day trading are the Stock market, and the Indices/Futures market because they have a lot of volatility and liquidity.

- The best times to day trade are when the European or US sessions are open.

- There are several trading strategies for day trading, like trend following, trend reversal, ranges, and breakouts.

On the «Reversal Trading» section, it says “When we are on an uptrend, we want to identify the start of AN UPTREND and start trading from there.” Shouldn’t it be A DOWNTREND, taking in consideration what follows on the next line of the text: “If we are on a downtrend, we want to find the INVERSE, the level where the trend is changing to an uptrend.”? The HIGHLIGHTS are mine, they are not on the original text.

On a side note: I’m really enjoying the content of this website, which I found searching for a strategy compatible with a full time job. So far I’ve been using a swing trading approach, but that involves constantly paying attention to economic news and economic indicators – and they are so many! Plus identifying trend lines, support and resistance lines, Fibonacci levels on pullbacks. This would be great if I had a part time job or if I was already retired, with enough time to consume all this information, in order to guess the right time and the right direction to enter a trade, to follow the trend for as much time as possible and gather the profits in a few days swing. But the truth is, I don’t have the time to follow the economy – the fundamentals that drive the prices and the markets.

If I can make some occasional gains in indices, it has been a complete failure in FOREX and specially in commodities – the information (news) from these is still more elusive, and the prices seem to move even more randomly, from one day to the next. So that’s the reason I found this website and the article «How To Day Trade While Working Full Time», which I enjoyed a lot. It gave me the perspective that I may find a winning strategy, based on price action and involving quick trades that only last for few minutes, that I can take early in the morning (07:30 – 08:30), before I go to work.

Thank you for your comments, I already fixed the text.

Most people think that day trading is only about spending the whole day in front of the screen. In fact, it can be done for just a few minutes per day. Much faster than swing trading too.