It is always a challenging task to find out the best stocks to buy.

But challenging doesn’t mean that is necessarily difficult.

You cannot invest in a stock without doing a proper analysis of the stock first.

Whether you are day trading or investing long term, if you jump to buy, you will be in big risk and you may lose your investment.

What stocks to buy?

– #FB: Facebook

– #APPL: Apple

– #NVDA: Nvidia

– #BABA: Ali Baba

That’s the ones that I trade every single day!

The most important thing: Never go with the crowd! And never listen to news!

The best stocks to buy can be easily found if you follow this step by step guide.

Before buying a stock, you have to do proper analysis and take all these important factors into consideration. Only then you can buy the stock and expect your account to grow.

Stay with me and follow these key points in order to find the best stocks to buy.

Wait for the right time to buy the stock

That’s a simple thing to say.

But what is exactly the right time to buy a stock?

Analyze your charts, and search for signals of a stock price starting to run.

Look at this example:

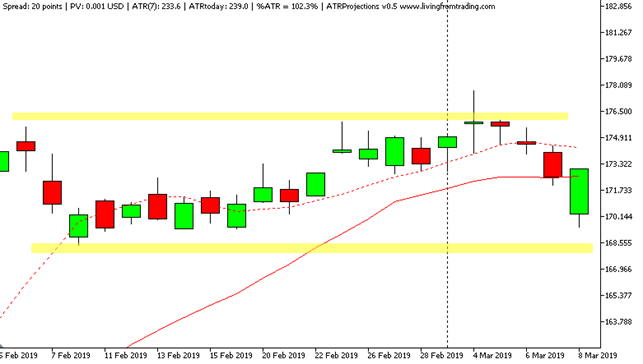

This is a daily chart from #AAPL.

As you can see the price was going sideways, not making new highs or new lows.

There’s nothing to do here, we just have to wait for the price to take a direction.

And you know that stocks trend a lot, right?

So, after a trend starts, you just need to follow that trend.

We waited a few days, and this is what happened to #AAPL.

Can you see it how clear was that break and start of the trend?

It was not a false breakout or whatever.

It was a genuine break and continuation.

An uptrend just started!

Now it’s even more simple.

What a newbie would do?

Hey, the price is going up, let me enter right away to catch all this uptrend!

Big mistake.

Big NO!

If you want to be a professional trader, you must trade like a professional, not like a newbie.

You already know that the price is going up, now just wait for the right place to enter.

You don’t catch a train while the train is already moving. You wait for the train to stop at the next station and then you can catch the train.

Trading is the same exact thing.

You wait for the price to stop, to rest, and that’s your place to get into the train.

And that means waiting for a pullback!

Wait for the price to come back, then you can buy the stock on the direction of the trend.

Watch out for possible resistances/supports on the way to your target

After you find a good setup, after a pullback, you need to check if the stock path is free.

You should not expect a big run if the price is near resistance or support.

Even if the price eventually breaks that resistance or support, it will very likely feel some rejection at first, and that may make your stop loss to be hit, and close your trade in loss.

Look at this example below.

I use moving averages as dynamic supports and resistances.

Did you see how the price hit that support and came back up?

You should never buy a stock (or sell) if you have trouble on the path to your profit.

That’s one of the rules you need to take into consideration when you need to choose the best stocks to buy.

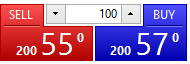

Watch the spreads that your broker sets on the stock

Do you know what the spread is and how it can mess with your trading profit?

Let me explain to you.

If you are buying a stock, you will buy at the price that the sellers are asking. That’s the Ask price.

If you are selling a stock, you will sell at the price that the buyers are willing to pay. That’s the bid price.

The spread is simply the price difference between the bid and the ask price of a stock.

The ask price is always above the bid price.

In this particular stock, the price is $0.2.

This means that as soon as you buy a stock, you are buying at a higher price, than the one that you can sell at that particular moment.

Vice-versa for short selling.

So, if you buy a stock and sell it immediately, you will actually lose money, even without the price moving.

When you buy a stock, you need for the price to move above the spread distance, on your trading direction, in order to actually be able to profit if you sell the stock.

You can see now that, the bigger the spread, the more the stock price needs to move in order to make you profitable trading.

Spreads are very important when it becomes to find the best stocks to buy.

You should always choose stocks that have low spreads.

The lower the time frame that you trade, the lower you need the stock spreads to be.

What’s exactly a low spread to target on a stock to buy?

We can’t really define an absolute value and say that the value is a low spread.

You know, you can find stocks with very different prices, from low-cost penny stocks trading at $0.0001 to big companies stocks that can cost hundreds or even thousands of dollars per stock.

Let’s say that we have a stock n. 1 that costs $10 and moves $0.10 a day.

And we have stock n. 2 that cost $200 and moves $2 a day.

And now let’s say that the spread of those stocks is $0.10.

On stock n.1 you need the price to move at least one whole day on your direction, in order to start having profit.

On stock n.2 you only need that price to move a few minutes for you to enter the profit zone. And you can even end the day profiting 20 times what you paid in the spread.

You can see that the same spread, $0.10, is horrible to trade stock n.1, but it may be interesting to trade stock n. 2.

How do I choose the best stocks to buy according to the spread?

Easy!

Forget numbers, just look at your charts.

A lot of times a visual analysis is better than real numbers, and this is one of the cases.

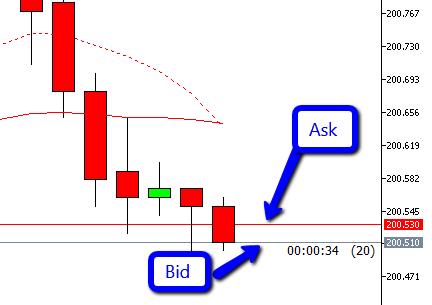

On your broker platform, activate both Bid and Ask line.

By default, you should only see one line, the Bid line.

By activating both Bid and Ask prices, you should see two lines on your chart.

The bigger the distance between them, the bigger the spread.

Now, very important, visualize the chart on the time frame that you use to trade.

Look at the place where you want to open your trade and look at where your target is.

If the spread erases a lot of that distance, then you should not trade that stock.

If the spread is just a small amount of that distance, then that’s a good stock to buy, regarding the spread criteria.

Look at the following example.

On the right, we have a stock with a big spread, not a good option to our trading strategy.

On the left, we have a stock with a good spread to trade our strategy.

Can you spot the differences between them?

How much the spread can eat your profits?

On the right, the spread is around 1/3 of your move between buy and close.

On the left, the spread is around 1/20 of your move between buy and close.

A huge difference!!

The spread can be the difference between you win or lose money!

Do you always check the spreads when you choose the best stocks to buy?

What about higher time frames?

On higher time frames the spread doesn’t have so much influence.

I mean, you can find more good stocks to buy that pass the spread criteria.

Because when you trade high time frames, the distances to achieve profit are also higher, so the spread has less influence.

But you should always be careful.

There are stocks that have high spreads, even for higher time frames.

My suggestion:

Set your chart on a high time frame, H4, Daily…

Activate both Bid and Ask line.

If the spread is small, your chart window will only show you one line.

That’s because the distance between the bid and ask line is so small, that you can’t really see both lines on the chart, just one on the top of each other.

If you can actually see two lines on the chart, then forget about that stock.

That spread is very big and it’s not one of the best stocks to buy.

Understand how commissions can affect your trade profit

When you buy a stock you usually pay a commission to your broker.

You pay the commission when you open the trade, and when you close the trade.

Commissions are an important part of the profit that you get on your account long-therm.

If you are paying high commissions that can actually make you lose money while you could be having profit with lower commissions.

So, how to understand if you should buy a stock or not based on the commissions that your broker charges you?

Let me show you an example.

Imagine a broker that charges $0.02 per share per side.

So, each time you buy a stock, you pay $0.02 to buy + $0.02 to sell (close).

That’s a total of $0.04 each time you buy a stock and then close the trade.

What’s the meaning of this value?

You can actually think about the commission of the stock as another spread.

In this example, you need the stock price to run $0.04 on your direction just to cover the commissions.

Let’s say that the spread for that particular stock at that time was $0.06.

You can add the spread to the commission, that makes $0.04 + $0.06 = $0.10.

That’s the amount of movement that the stock that you buy needs to run on your direction in order for you to start making profits.

Then you mark that on your charts and analyze as the previous example.

Does your spread + commission red rectangle look like the picture on the right or like the picture on the left?

If it’s a small rectangle, go for it, you have good chances of making money.

If that’s a big rectangle, forget about that trade. That’s not one of the best stocks to buy. At least not on that particular setup and time frame.

Don’t forget about minimum commissions.

Brokers often charge minimum commissions to your transaction.

If you buy a small number of shares, your commission will be set as a minimum commission and not as a percentage of the number of shares that you bought.

Example: We already that that particular broker charges $0.04 per share of that stock. Now imagine that the broker charges a minimum commission of $1 per side. That makes $1 to buy the stock + $1 to sell the stock, a total of $2.

If you buy 100 shares of that stock you pay: 100 * 0.04 = $4 in commissions.

If you buy 50 shares of that stock you pay: 50 * 0.04 = $2 in commissions.

Both of these examples are fine because the commissions calculated are above the minimum.

But if you buy less than 50 shares, the weight of the commission on your trades will be huge.

If you buy 25 shares of that stock you pay: 25 *0.04 = $1 in commissions. But this value is less than the minimum, $2, so you pay $2 in commissions and not $1.

That makes $2 / 25 shares = $0.08 / share of that stock!

You see, now instead of a $0.04 move in order to cover commissions cost, you need a $0.08 move to cover that cost. And the lower the amount of shares that you buy, the higher will be the cost per share.

The lower the number of shares that you buy, the bigger will need the movement of the price to be, in your direction, in order for you to cover the commission’s cost.

That’s a terrible deal for you. That will make you lose money in the long-term.

Never buy a number of stocks that makes you commission go below the minimum, otherwise, you’ll get a huge disadvantage on your trade.

That can actually be the difference between being profitable or not trading stocks.

Conclusion

The examples I mentioned above are some of the most important factors that can make the difference whether you buy a stock and get profit or not.

Basically, you need to:

- Wait for a run to start, don’t try to guess. Just wait for it to start. Then wait to enter on the right place. Get on the train when he stops to make a pullback. Don’t try to catch it.

- Watch out for supports or resistances on the way to your path. If you have trouble on the path, it’s better to leave it. There’s probably a better stock to buy.

- Analyze the spreads that your broker charges you. If they are too big, they will eat a lot of your profit and make you a loser on the long-term. You want to be a winner, not a loser.

- Analyze the commissions. It’s the same as the spreads. If you are being charged with big commissions that will make the hedge of your trading strategy to decrease, until a point where you can’t have profits.

If you follow these rules, you’ll probably find the best stocks to buy easily.

I follow them every day on my trading room and I teach them to all my students.

That’s part of the process of becoming a professional trader.

Apply for a free trading class with me, and you’ll learn a lot of more cool stuff.

Good trades and good profits!

I’ve been absent for some time, but now I remember why I used to love this blog. Thanks, I?¦ll try and check back more frequently. How frequently you update your site?

The blog and all my social media are updated frequently.

Get more updates by following me there.

Thank you!

I have learn several good stuff here. Certainly price bookmarking for revisiting. I wonder how so much attempt you set to create one of these excellent informative website.

Thank you!