The futures markets are one of the most popular markets to trade. They are very attractive for traders and investors and they can be a good profit center when you know what you are doing.

Traded by professional traders from around the world, they provide good volatility, liquidity, and potential good profit returns.

Some futures contracts are much better to trade than others. In this article, you’ll learn what are the most popular ones and the main differences between them.

Futures market volatility, why is it important?

Volatility measures how much the price moves within a certain period of time.

As traders, we want the markets to move to make profits. We don’t profit from markets that don’t move or that are pretty much sideways most of the time.

And you know what, the Futures market is one of the most volatile markets that exist. A lot of people think that the forex market has the highest volatility, but that’s not right. Actually, the forex market is one of the less volatile markets. That’s one of the main differences between trading Futures Indices vs Stocks vs Forex.

But I heard that volatility is dangerous for day traders…

Only people that don’t know what they are doing say that.

Volatility is good, and the best part, it allows you to make quick trades lasting just a few minutes, and with a potential good profit return.

Yes, that’s right…

You don’t need to wait several hours for the price to move, like in the forex market. The futures market price makes decent fast moves in low time frames that allow traders to take quick trades in and out.

You wait for the right setup and you nail it like a sniper.

Volatile markets, like the Futures markets, also make the trading setups more accurate. The price tends to trend, instead of moving in a sideways messy movement.

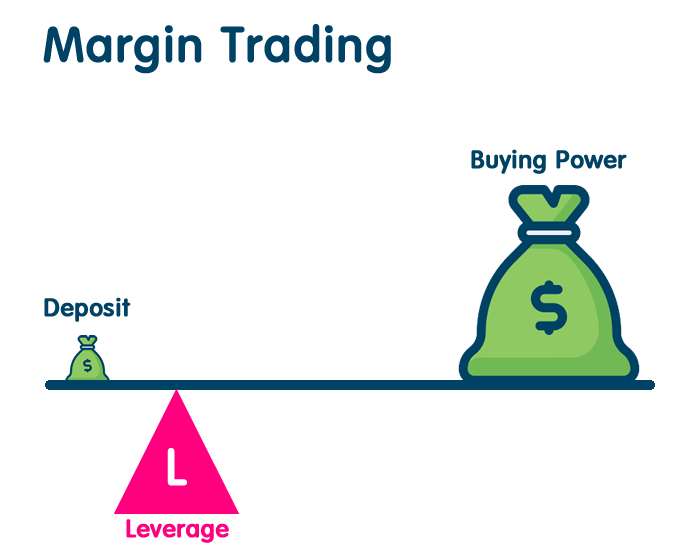

And by the way, the forex market is only dangerous not because of the volatility, but because of the high leverage that brokers usually provide. Newbie traders don’t know how to manage their risk, so they end up taking trades using a lot of leverage, and small movements in the market hurt their accounts very badly.

How good is the Futures Market liquidity?

Liquidity is related to the number of traders (and consequently their amount and size of pending orders) that are trading a specific market at a specific moment. The more traders are active in the market, the higher the liquidity, and the easier it is to fill your orders at the price that you want them to be filled.

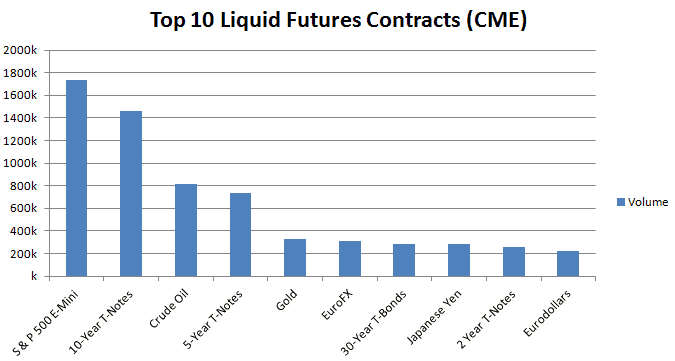

According to TradingSim, using data from the CME Group, these are the most liquid Futures contracts to trade:

The best Futures markets have high liquidity, which makes them attractive to trade.

And why is that important?

When you open or close a trade, you want that to happen at the price that you set to make that execution or at least the closest possible to that price.

You don’t want to hit your buy button and your trade to open far away from that price, sometimes at the price where you would want to close that trade.

The distance, between the price at that you want to open your trade, and the price that the trade actually opens is called slippage. This is especially bad when you are scalping and trading low time frames.

When a market has high liquidity, like the most popular Futures markets, there are a lot of traders that are willing to take the counterpart of your trades at that specific price, or very close to it.

This leads to lower slippage on your trades execution since they get executed at the prices that you want, either when you are buying or selling.

Another thing to consider regarding liquidity is price manipulation. Markets with very low liquidity can easily be manipulated by large traders.

The lower the liquidity, the easier it is to manipulate the prices.

That’s why you also want to stay away from low liquidity markets.

How much margin do I need to day trade Futures?

The margin is the amount of money that you need to have in your trading account to be able to buy/sell a Futures contract. That value depends may be different depending on the broker that you are using.

One popular Futures Trading broker is NinjaTraderBrokerage. Their margins are quite good to trade.

If you trade Mini Futures contracts, you only need as much as $500 for a contract to trade Mini contracts like E-Mini S&P500 (ES), E-Mini NASDAQ (NQ), E-Mini Russel 2000 (RTY), or E-Mini Dow Jones Indes (YM).

For trading Mini-DAX (FDXM) you need €1000 of margin.

Are those margins very big for you?

Good news for you, you can also trade Micro Futures contracts!

Micro contracts like Micro E-Mini S&P500 (MES), Micro E-Mini NASDAQ (MNQ), Micro E-Mini Russel 2000 (RTY), or Micro E-Mini Dow Jones Index (MYM) can be traded with as low as a €50 margin for each contract.

Micros are a good starting point if you are new to Futures Trading.

Best Futures to trade regarding fees and commissions?

Fees and commissions from Futures trading can impact your trading results.

Some brokers have fixed commissions, others where may charge different commissions depending on the number of contracts that you trade on average.

How do you measure the fees and commission’s impact on your trading?

The best and simplest way is to consider fees and commissions as an additional spread.

When you open a trade, you usually pay a spread to your broker. The spread is the distance between the bid and the ask price. This means that when you open a trade you are immediately in negative territory.

In order for your trade to go into profitable territory, the price must first move in your trade direction, the same distance as the spread size.

But that’s a fake profitable territory…

Why?

Because your futures platform P&L may show your trade with a profit, but in fact, you still have to pay the fees and commissions to your broker and exchange.

This means that the price must move even more in the trade direction so that the trade is really in profit territory.

Let’s take a look at some of the most popular Futures contracts specifications:

DOW JONES INDUSTRIAL AVERAGE

| INDEX | TICKER | POINT VALUE | FEE+COMMISSIONS | ADD TO SPREAD (pts) |

|---|---|---|---|---|

| E-mini Dow | YM | $5.00 | $2.10 | 0.42 |

| Micro E-mini Dow | MYM | $0.50 | $0.47 | 0.94 |

Comparing the Mini Dow with the Micro Dow, we can see that when you trade Micro Dow, you need the price to move 2.24x more in order to cover the fees + commissions.

NASDAQ

| INDEX | TICKER | POINT VALUE | FEE+COMMISSIONS | ADD TO SPREAD (pts) |

|---|---|---|---|---|

| E-mini NASDAQ | NQ | $20.00 | $2.10 | 0.11 |

| E-micro NASDAQ | MNQ | $2.00 | $0.47 | 0.24 |

Comparing the Mini NASDAQ with the Micro NASDAQ, we can see that when you trade Micro NASDAQ you need the price to move 2.18x more in order to cover the fees + commissions.

S&P 500

| INDEX | TICKER | POINT VALUE | FEE+COMMISSIONS | ADD TO SPREAD (pts) |

|---|---|---|---|---|

| E-mini S&P500 | ES | $50.00 | $2.10 | 0.04 |

| E-micro S&P500 | MES | $5.00 | $0.47 | 0.09 |

Comparing the Mini S&P 500 with the Micro S&P 500, we can see that when you trade Micro S&P 500 you need the price to move 2.25x more in order to cover the fees + commissions.

DAX

| INDEX | TICKER | POINT VALUE | FEE+COMMISSIONS | ADD TO SPREAD (pts) |

|---|---|---|---|---|

| DAX | FDAX | €25.00 | €1,51 | 0.06 |

| Mini DAX | FDXM | €5.00 | €0.80 | 0.16 |

Comparing the DAX with the Mini DAX, we can see that when you trade Mini DAX the price needs to move 2.67x more in order to cover the fees + commissions.

From these tables, we can clearly conclude that when you trade the micro version of Equities Futures, the price needs to take bigger movements in the trade direction, in order to cover the fees + commissions charged by your broker and exchange.

In all the examples, the movement that you need for your trade to go into profit is more than 2x than what you need when you trade the big brother version.

So, should you trade the Minis instead of the Micros?

If you have enough capital, that would be the best choice. But if you don’t have it, don’t worry, and trade the Micros. It’s a good starting point for beginners trading futures.

And if you are successful at trading the Micros, then you have all it takes to trade the Minis successfully too, because they deliver profit sooner than the Micros.

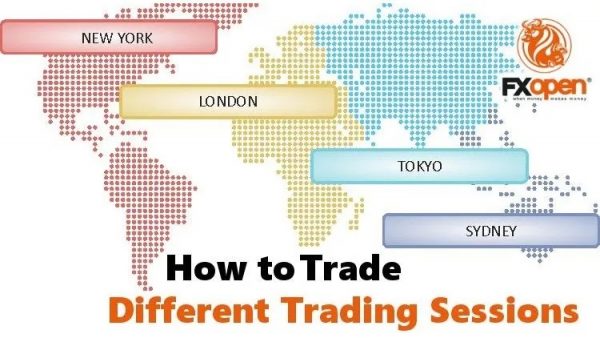

Which Futures should you trade in your time zone?

Depending on the time that you are trading futures, or the time zone that you are in, some futures contracts are better than others.

If you trade the London session, trading DAX Futures is the best contract to trade. US Futures Indices, like NASDAQ, Dow Jones, or S&P 500 are also good to trade during this period, although they tend to follow DAX movements.

When the New York session opens, US Futures Indices start to lead the market. NASDAQ, Dow Jones, and S&P 500 are the better ones to trade. You can also trade DAX during this period, but opposite to what happened during the London session, DAX tends to follow the US Indices during this period.

The Asian session is also a good session to trade. You have the Hong Kong index (HK50) and the Australian index (AUS200) that tend to make great moves during this period, especially the opening of the Asian session. US Indices, like NASDAQ, also tend to have good moves and provide great setups for day trade during this period.

Which Futures are my favorite to trade?

I personally trade the opening of the London session and the opening of the New York session.

Although there are several types of contracts, I always go for Indices trading.

My favorite Futures contracts to trade are DAX, during the morning of the London session, and Dow Jones, during the morning of the New York session.

But as you know, there is much more to choose from depending on all the factors that we went through in this article. What is better for me may not be what is better for you.

What about you? What are your favorite futures contracts to trade?